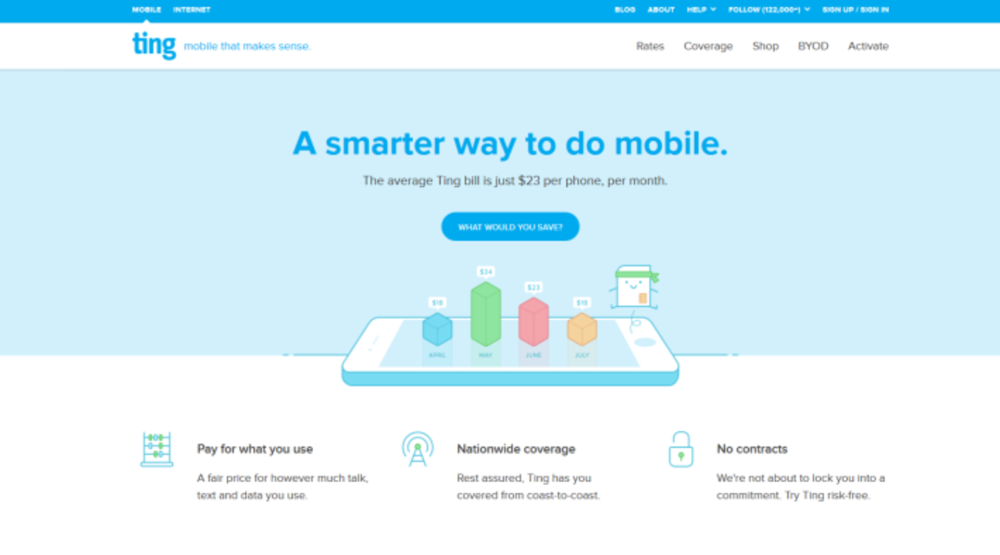

Photo source: Ting

The population of smartphone owners is booming. Seventy-seven percent of Americans have a smartphone, according to Pew Research Center’s November 2016 data, and this figure has more than doubled since 2011.

But getting the latest and greatest device comes with a price. The iPhone 7 Plus with 32 GB currently costs $769 per Apple, and the Galaxy S8+ with 64 GB (unlocked) costs about $675 per Samsung’s website.

As a result, many carriers and smartphone brands have started offering customers monthly payment options. After listening to its own customers, Ting – a mobile network and service provider with a quarter of million U.S. customers – decided to do the same and implemented financing solution Affirm.

Listening to the customer

Like any brand, Ting is charged with appealing to two types of customers: new and existing. The company found that both audiences were facing disappointing payment situations when it came to financing a new phone at their end of their device life cycle.

When it came to existing customers, Ting’s head of product and digital strategy Justen Burdette says customers loved their brand experience; however, some were leaving when it came time to upgrade their phones. After interviewing former customers, Burdette says the brand confirmed that many customers would have liked to stay with Ting but they didn’t want to pay full price for a new phone upfront.

“As we dug into that, it was a real trend,” Burdette says.

The same was true for new customers. It’s common for customers to look at other carriers near the end of their device cycle to see if they can get a deal on the latest phone, Burdette says. But because Ting didn’t offer any payment plans, Burdette says, the brand missed opportunities to acquire new customers looking to switch.

After researching some financial solution providers, Ting decided to implement Affirm. Burdette says it was important for Ting to offer the same 24-month payment plans that the big carriers offered and that the payment plans benefitted the customer, as well as the brand.

“They really do share our concern for our customers,” Burdette says. “It wasn’t just about making a quick benefit.”

So, Ting launched the financial solution on its website in October.

Going through the process

Here’s how the purchase process works from a customer’s perspective: Customers can visit Ting.com and shop for a new smartphone. Once they select their device, they’ll be asked to either sign into their existing Ting account or create a new account if they’re a new customer. The new account form asks customers to provide their name, email address, and phone number and invites them to opt in for Ting’s email and mobile notifications. They’ll also be asked to provide their address, so that Ting can verify if the brand services that area. When it comes to purchasing the device, new and existing customers can pay for the phone in full upfront via a credit card or Amazon Pay, or they can apply to pay monthly payments via Affirm. Then, customers will enter their shipping information, confirm their order, and complete the Ting portion of the checkout process.

It’s not until after customers complete this portion of the checkout process that the Affirm process begins. According to Ting’s website, customers who opted for the payment plan will see an Affirm pop-up asking them to provide their name, email address, phone number, birthday, and the last four digits of their social security number. This allows Affirm to conduct a “soft credit check,” notes Ting’s website, and set up an Affirm account. Customers will then be texted a pin number, which they’ll be asked to provide as a verification code. Affirm will then notify the customer whether or not they’ve been approved for financing and provide them with their approved payment plan options. After customers select their plan and agree to the necessary terms, their order will go through and they’ll receive their order confirmation indicating when their device will ship, which will be sent from Ting.

Burdette says that any data provided to Affirm stays with Affirm and is not shared with Ting. He says that this allows customers to leave Ting if they’re unhappy with their service but still pay off their phone with Affirm – even if they join another network. He says that this plays into Ting’s brand value of fairness. Of course, customer retention is always the goal.

“We hope to convince folks to stay, and we work pretty hard at that,” he says.

Making marketing moves

The goal was to have Affirm available to all customers by Black Friday. Around this time, Ting offered financing options for a Motorola device and emailed customers about these payment plans. Burdette says that the device sold out within “a few hours.”

Since then, Burdette says Ting has continued to include Affirm pricing options in its marketing. He says that the brand markets via a number of digital channels, including email, social, search, podcasts, and display. Showcasing Affirm’s payment option prices, he says, has been particularly good for Ting’s SEO.

“So far, it’s really marketed itself,” he says.

Generating results

In terms of results, Burdette says that Ting’s churn rate last quarter was 2.27%. He also says that the brand experienced a 21% decrease in churn among customers who updated their phone with Affirm, specifically.

In addition, Burdette says that the brand saw a 42% increase in conversion last fall when it conducted an A/B test and showed Affirm payment plan prices to some customers and hid them from others.

As for lessons learned from this experience, it seems like Burdette took home an oldie but a goodie.

“It’s something that we’ve tried to do from day one,” he says, “but it’s always listen to your customers.”