While the industry waits to see if Microsoft will acquire Yahoo based on its $44.6 billion bid, analysts are speculating about what the deal would mean to the online advertising space.

“This is the best opportunity for Microsoft to insert its technologies in front of a large audience,” says David Card, analyst at JupiterResearch. “It has been a leading platform company for decades but it is at risk of losing this position to Google.”

Representatives from Yahoo and Microsoft could not be reached in time for comment. In a statement, Steve Ballmer, CEO of Microsoft, says a merger would “deliver better choice and innovation to customers and industry partners,” of both firms.

Competing with Google may be the main driver for Microsoft, as the software giant grapples to remain relevant in the changing online landscape. Google has offered public statements on antitrust issues relating to the proposal.

“Yahoo’s large audience and existing platform makes it a good option for Microsoft to [potentially] compete with Google,” says Michael Gartenberg, analyst at JupiterResearch.

While questions remain about how the two firms’ various technology and product offerings would be distributed in a combined entity, the two main channels that this kind of merger would affect are search and display ads. For online content publishers, the merger could ease the issue of where to buy.

“This would be great for our clients,” says Tim Schaden, CEO at search marketing firm Fluency. “It would make keyword buying easier and more cost-effective.”

While losing one of the competing firms might be expected to raise prices and reduce choice for advertisers shopping for search inventory, the merger might actually help price, according to David Graves, analyst at Forrester Research. He says that if the acquisition goes through, Microsoft would be acquiring Yahoo relationships with small and midsize businesses.

“Microsoft has historically had competitive pricing, and it may offer cost per clicks much cheaper than Google,” he says. “Marketers don’t care where they get their leads from as long as they are generating leads.”

Having fewer big platforms is useful for marketers when it comes to Web analytics. If one firm is controlling a large number of the consumer contact points, then it could be easier to aggregate this information. “If it can pull all of this inventory and tracking into one platform it will make everything easier,” Gartenburg adds.

Still this could take some work on Microsoft and Yahoo’s end. “People spend less time on the portals and the Yahoo/Microsoft company will need other publishers to let them sell their inventory in order to be successful in the long term,” says Roy Shkedi, founder/CEO of AlmondNet.

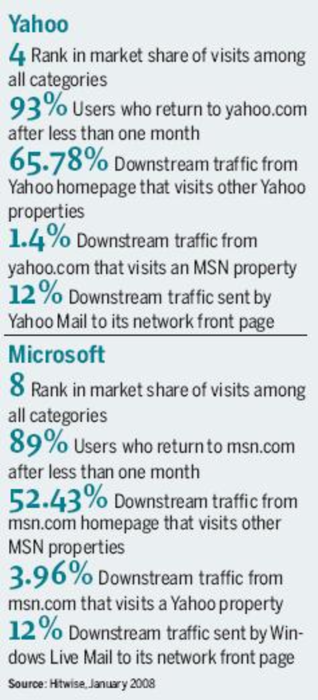

This potential merger will also affect the mobile and e-mail spheres. While most analysts agree that both Yahoo Mail and MSN Hotmail would continue to exist as separate brands so as not to disrupt consumers, there is speculation on whether mobile properties Yahoo Go or Windows Live would integrate or vie for dominance.

“Now is the time to focus on the user experience in mobile and Google is a leader in this,” says Juliet Ask, analyst at JupiterResearch. “If Microsoft were to spend the next 18 to 24 months trying to integrate its systems, it may lose out on the window of opportunity to build an audience. It should pick one and move forward.”