The Home Depot?

2,200 stores?

Launched e-commerce in 2000?

Lowe’s?

1,750 stores?

Launched e-commerce in 2000?

With more and more consumers using digital technology throughout the purchase process, home specialty retailers such as The Home Depot and Lowe’s are bridging their in-store offerings with a multichannel approach to keep up with the various consumer touchpoints. The two companies share a foundational strategy and execution, if little else. ?

With 450 more stores than Lowe’s, Home Depot enjoys a larger footprint than its most direct competitor. Despite that physical advantage, the two companies’ e-commerce sites are relatively even. According to Compete.com, Home Depot received 19.2 million unique visitors to its homepage in April 2011, while Lowe’s was close behind with 17.9 million. ?

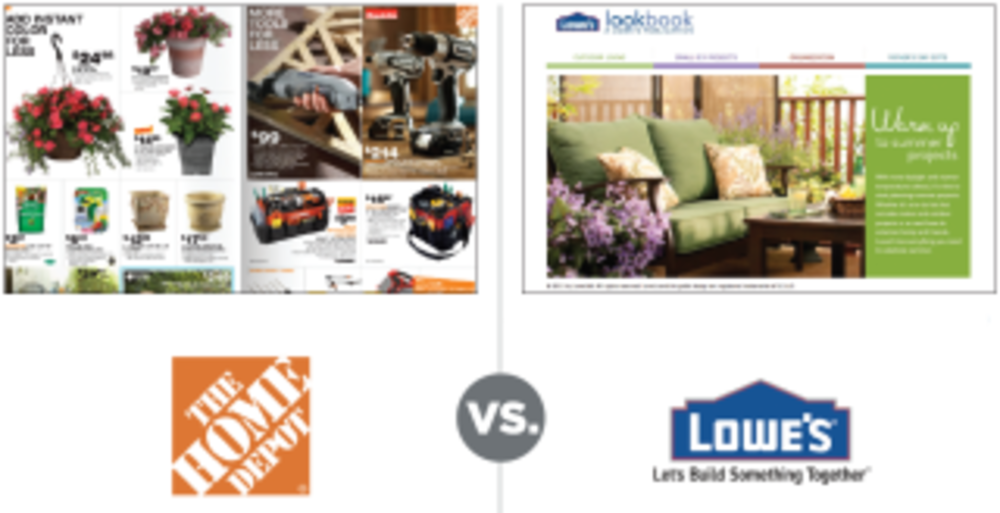

On the surface, the e-commerce sites of Home Depot and Lowe’s could be fraternal twins. Both dedicate the majority of their homepages to product promotion. Both thread how-to information throughout the site. They even use the same SMS short code service. ?

When Direct Marketing News opted in to product news via the brands’ online circulars, the text messages from Home Depot and Lowe’s showed up in the same conversation stream because they came from the same number. For better or worse, the general homogeneity permits the differing details, whether they are valuable innovations or missed opportunities, to chasm the two brand experiences. ?

Home Depot’s e-commerce homepage maintains a streamlined effect with a focus on product promotion, whereas Lowe’s is much busier with multiple offers and features. Casey Sheehan, design director at interactive marketing agency SapientNitro, praises Home Depot’s “clean and simple approach.” ?

“It’s just a rich take on products,” he says. “They’re not pushing promotions down your throat. It’s really just about giving you almost a one-page brochure experience on their homepage.”?

Lowe’s, however, includes consumer-generated product ratings alongside items on the category pages, which can also help an unsure shopper. Home Depot includes these ratings on a product’s landing page or in its “Quickview” overlay, which only displays one product at a time. Home Depot also gives consumers the ability to share products to social networks. ?

“The share feature in today’s day and age seems like table stakes. It’s such an easy thing for a brand to execute on, and I’m actually surprised that Lowe’s is not doing that,” says Sheehan. He was also surprised by the absence of a Lowe’s mobile app for consumers. ?

Lowe’s has developed one for realtors, but consumers are limited to the retailer’s mobile-optimized site whose primary function is m-commerce. Home Depot complements its mobile site with an iOS app that features how-to videos and a virtual toolbox that can convert an iPhone into a tape measure, nut and bolt finder or paint calculator. The app also features a barcode reader to scan in-store quick response (QR) codes, which deliver product information and how-to videos.?

“We know customers are increasingly using their mobile devices to assist in the purchasing process, and using QR codes enables us to more closely connect our stores and customers to our digital content,” Home Depot said, in a statement to Direct Marketing News. ?

Unfortunately, the Android version of the app does not feature how-to videos, a virtual toolbox or QR code reader.?

The competition flip-flops when it comes to email marketing. Lowe’s dominates the channel, if only by following the Woody Allen adage of simply showing up. Lowe’s sent an introductory email a few hours after subscribing on the company’s e-commerce site, while it took Home Depot two weeks to send its first note even after ?Direct Marketing News subscribed to Home Depot’s five email newsletters — including ones dedicated to the local weekly ads, in-store and online promotions, home improvement education and two from the retailer’s Garden Club. ?

Home Depot did not respond to questions about its email marketing strategy.?

“If I subscribe to a brand and have shown that much interest, just having a courtesy welcome email is given,” says Sheehan. “That’s a huge missed opportunity.”?

Home Depot’s email mirrored its straightforward e-commerce homepage with much emphasis on its products augmented with seasonal offers. Lowe’s initial email includes a link to its subscription preference center, at which consumers can opt-in to any or all of the company’s nine emails that are sent out on weekly, monthly, seasonal or occasional schedule. Both companies’ emails include links to weekly ads and a store locator. Both companies also include product discounts in their emails, but only Lowe’s specified the date when an offer expires. ?

Neither Home Depot nor Lowe’s have implemented an abandoned shopping cart email program.?

Lowe’s also edges out Home Depot with its direct mail offerings. While Home Depot serves up various catalogs and how-to guides, like its Outdoor Power Guide, its offerings feel like a catalog-cum-textbook in comparison with Lowe’s three custom magazines, such as Lowe’s Creative Ideas, which shirks product shilling for the type of consumer-friendly content usually found in a lifestyle magazine.?

While Lowe’s magazines bake in authenticity, this is not always present in its social media channels where the retailer spends more time on product promotions and offers. When it does pose a fun question, though, its customer response rate succeeds Home Depot.?

For example, a May 17 Facebook post asking whether toilet paper should roll over or under generated 1,494 comments and 420 likes within a week. Home Depot spends more time on its Twitter page than on Facebook and its fan counts reflect this, as does customer engagement on each channel. For example, from May 1 through May 21, Home Depot averaged 104 comments per Facebook post; Lowe’s averaged 299.?

Noah Mallin, VP and group director of social media at digital agency Digitas, notes that a successful social strategy for retailers is to deliver value, and not just in the form of deals. “It should feel genuine,” he says. “It shouldn’t feel like a sales pitch.” ?

In terms of branding, Home Depot’s size is both an advantage and disadvantage. It performed well on Interbrand’s “Best Retail Brands 2011” study, coming in at No. 3, just behind Wal-Mart and Target, while the smaller Lowe’s ranked 13. Yet, J.D. Power & Associates‘ 2010 US Home Improvement Retailer Satisfaction Study revealed Lowe’s delivers a superior in-store experience to Home Depot based on customer service, store facility, merchandise and price.

Brand Champion

Details delineated the Home Depot vs. Lowe’s rubber match. Home Depot’s email and social strategy may be to avoid over-messaging its consumers, but that restrained approach allows Lowe’s to engage consumers not particularly loyal to either retailer. Home Depot may succeed at the point of purchase, but Lowe’s lays a more compelling path to getting there. ?