Segmentation plays a critical role in a targeted marketing strategy, but many companies are shying away from large-scale attitudinal studies and looking for more practical ways to apply segmentation.

Many marketers have invested heavily in attitudinal studies intended to pinpoint personality types in order to build a marketing strategy around those segments. Often, these companies have been unable to find customers in their databases or prospect lists that actually fit the mold of the five or six segments produced by the studies.

“There’s been a growing experience that people have been disappointed by [attitudinal] segmentation,” says Eric Hogue, VP strategic services at Millward Brown, a research company. “It is no longer enough to say, ‘We are going to find these really cool groups, and we’ll figure out the marketing piece of it later.”

Instead, marketers increasingly look to metrics that are identifiable in the marketplace as the basis for building customer segments that are more innately usable. Some are combining internal customer data with market research and other data to create a single segmentation model that provides a more complete view of the customer.

Total Non-Stop Action Wrestling, which appears on Spike TV, a cable channel, wanted to launch more relevant and targeted marketing to its fan base, but felt limited in its capabilities by disparate e-mail, text messaging and Web site platforms.

“We’ve got all these customer names, but we didn’t know what to do with them,” says Dan Stevenson, director of marketing at TNA Wrestling. The marketer has grown quickly since its 2002 launch. In January, TNA went live with a digital marketing platform that enabled it to segment customers and target communications on its Web site, via e-mail and mobile. The solution, provided by Knotice, an e-mail marketing company, also enabled TNA to consolidate its databases for all three channels into one platform.

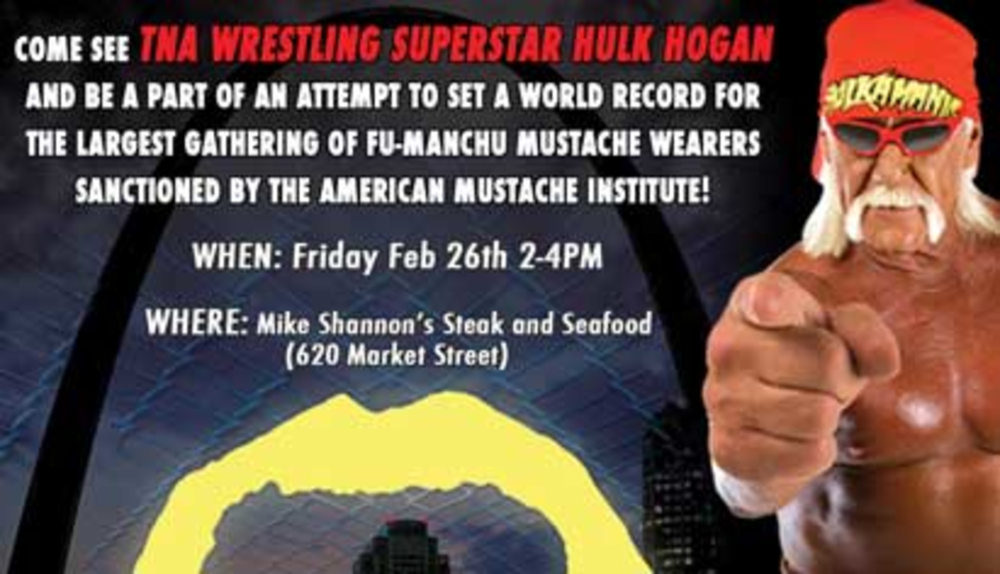

In February, the company sent out 30,000 e-mails to customers in and around St. Louis to promote an upcoming pay-per-view event taking place in April. The e-mails also showcased an appearance by Hulk Hogan and challenged fans to see how many people with mustaches like Hogans’ could fit in one room. The e-mail had a 28% open rate.

“We really want to reach out to our fans whenever there is something going on that they might be interested in and target these communications,” Stevenson says.

The ability to geo-target is significant, he adds, because the company has programming in 100 countries and does live events around the US, in addition to its Spike channel and pay-per-view presence. While the company was doing e-mail and text messaging previously, now it “has the ability to keep everything in house so we can control the data and what we send out,” he says.

Through segmentation and targeting, TNA Wrestling expects to be able to cut its spend on traditional marketing this year and focus more on digital efforts, with text messaging, e-mail and dynamic content on the Web site. It also expects to increase revenue on the Web site through dynamic content that will enable it to cross-sell to customers with relevant offers.

There’s also a growing trend among marketers to supplement transactional customer data with market research and ethnographic data to provide a more complete view of the customer. This has been talked about for a long time, but it is only recently that marketers have begun to put it into practice, says Dave Frankland, principal analyst at Forrester Research.

“Historically, these different types of data were kept very distinct and used by different teams within a marketing department,” says Frankland.

Over the past year, particularly driven by the need to reduce budgets, these different groups have started to come together to create a single segmentation model. This is evident in some companies, but it is not widespread yet, Frankland points out. More marketers should begin picking up on it, however, when they realize it produces better results.

“The better I know my customer, the more I can — in theory — send more relevant offers and improve my advertising because I can target my advertising at my most profitable segments,” explains Frankland.

PetSmart is one marketer that works with all the data available to it in order to make informed business decisions, he continues. Recently, the pet supply store faced a double whammy when the economy began suffering and Wal-Mart, whose low prices have been known to dent other retailers’ sales, announced its intentions to invest in the pet category. PetSmart reacted by surveying its customers, which had been segmented into three primary groups, asking them how many shop at Wal-Mart. The results showed that while PetSmart’s less profitable customers do shop at the big-box retailer regularly, its most profitable customers don’t. As a result, PetSmart decided not to compete with Wal-Mart on price.

“PetSmart was able to make an important business decision” by marrying together transactional data with what it learned from the survey, says Frankland.

The move appears to have been a prudent one. For the year, PetSmart reported sales totaled $5.34 billion, up 5.4%. Comparable store sales grew 1.6% during the same period.

Leveraging customer insights is one of PetSmart’s top three strategic priorities in 2010, company executives said during a recent earnings call with analysts. One opportunity the company sees from this strategy is to drive incremental store visits from one of its key customer segments representing more than half of the customer base. The company will promote its exclusive products, proprietary brands and services model to accomplish this goal.

Part of what is driving the continued focus on segmentation is that consumers say they want to receive targeted, relevant messaging. In a recent survey from the CMO Council and InfoPrint Solutions Co., of the 91% of consumers who had opted out or unsubscribed to e-mails from a brand, 46% said they had done so because messages weren’t relevant. Forty-one percent of respondents said they would consider ending a brand relationship due to irrelevant promotions, while 30% said they are inspired to do business with a company after receiving personalized communications.

While marketers want to engage in more targeted communication, they have always faced major challenges, says Brian Deagan, CEO at Knotice.

“The data is really half the battle” when it comes to successful segmentation strategies, he says. “Marketers today know that segmentation and data is key to making targeted marketing happen, but they need to rethink the data collection mechanisms.” That is because it can be difficult to gather all the relevant customer information from different media channels and get it into a single marketing database.

Another roadblock is that different channels use data differently. The online channel, for example, only knows a few things about customers, such as age and gender. A phone representative must decide what questions they can ask to figure out which segment a caller falls into. A good segmentation program will provide flexible tools for each channel to use.

“The challenge is how you line up these data to find out what segment a customer belongs in,” Hogue explains.