The direct and digital marketing space has seen a torrent of mergers and acquisitions in the past several weeks, including buys by marketing software company Unica, search marketing firm Covario, integrated agency Barkley,

e-mail firm Experian and digital agency Rosetta.

Agency executives said this increase in acquisitions can be attributed to firms filling gaps in geographies, service models and offerings. Yet others are more optimistic, saying this is an indication of the economy recovering, as well as an opening up of the credit markets.

Chuck Cordray, SVP and GM of digital media at Hearst, said that “from our perspective as a seller of advertising, the acquisitions in the mobile space are positive.” Yet, he cautioned that industry players should temper their hopes.

“Now that the larger players are providing the dollars in mobile, there are scale opportunities,” he said. “It doesn’t mean a huge ramp up of Q1 mobile advertising, but it is a necessary precursor to see what will happen in 2010.”

From the buyer’s perspective, signs of recovery in the economy at large mean companies are becoming more active in the acquisition space, said Jeff King, CEO of Barkley, which acquired a smaller agency, Blacktop Creative, last week.

“During a recession, demand slows and prices get pushed down,” he explained. “As soon as signs of recovery present themselves, companies become more active and more likely to [acquire companies] than they were a couple years ago.”

Russ Mann, CEO of Covario, which announced the purchase of search marketing agency NetConcepts last week, agreed that agencies are more confident now than last year. They’re also sensing an opportunity to change their business models, he said.

“In the technology sales and advertising sales pipelines, companies are now confident that people will continue to buy advertising, so they’re ramping their [acquisition] spend,” he noted. “If you want to change your model, now’s the time, because currently, many companies are able to complete opportunistic buys in a financially responsible way.”

In recent weeks, Unica bought e-mail deliverability firm Pivotal Veracity for nearly $18 million, and e-commerce firm ATG acquired live chat service provider InstantService for $17 million. Meanwhile, Barkley bought Blacktop Creative, Covario bought NetConcepts and Rosetta acquired Wishbone, all for undisclosed sums.

In December, Groupe Aeroplan acquired Carlson Marketing Worldwide for more than $175 million. Groupe Aeroplan said at the time that it was acquiring Carlson to diversify its business model to include a broader range of loyalty management services.

Michael Kessler, managing director of Veronis Suhler Stevenson, a private equity firm that specializes in the media and communications industry, noted that he’s seen deal activity increase due to improved credit availability and service providers looking to improve their offerings.

“We’ve definitely seen an increase in opportunities. We’ve seen a number of marketing services opportunities in the last three months in particular,” he said. “I definitely expect deal volume in 2010 to be greater than 2009. It’s the opening up again of credit markets and an attractive stock environment that has companies feeling good about themselves again.”

Bruce Biegel, managing director of Winterberry Group, a consulting firm affiliated with Petsky Prunier, said that the beginnings of an economic recovery are a time when “good companies are buying other good companies to fill capability gaps.”

“This year we’re going to see the death of the ‘digital agency,’” he predicted. “We need to make moves so that we’re more holistic — just an ‘agency.’”

Elana Anderson, VP of products for Unica, said that her company’s acquisition of Pivotal Veracity is indicative that “especially in the software, marketing and technology markets, we’re going to have constant ebbs and flows of innovation and consolidation.”

“And for the many small technology companies out there, the economy has sped the process up,” she added.

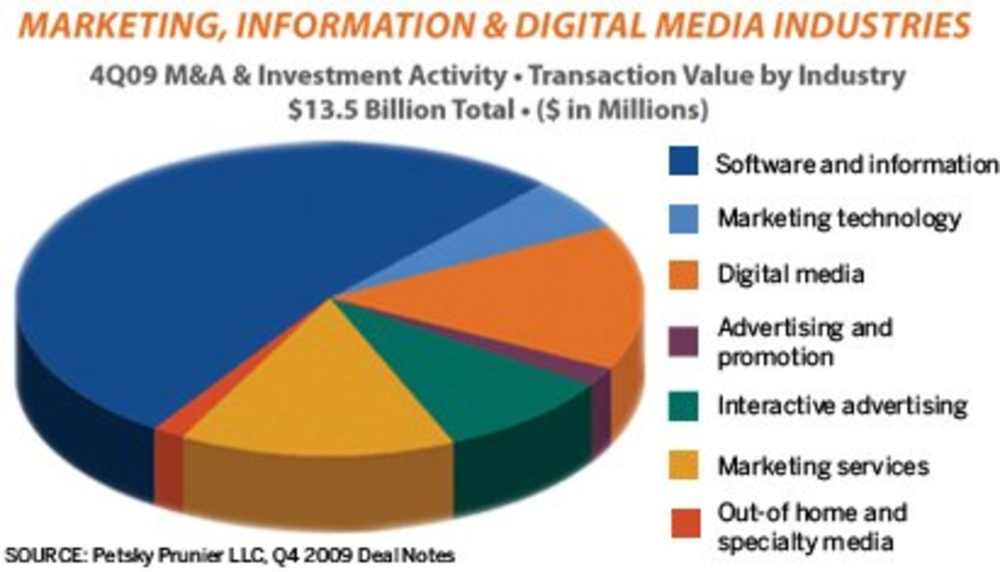

The increase in mergers and acquisitions actually began late last year. Petsky Prunier released its fourth-quarter review of M&A activity for 2009 in December. The roundup looked specifically at the marketing, information and digital media industries, and the results showed an increase in spend beginning in the third quarter. While in the second quarter M&A activity was $2.4 billion, that number jumped to $7.6 billion in Q3 and rose sharply to $13.5 billion in Q4.

Shawn Polowniak, founder of Blacktop Creative, which was recently acquired by Barkley, said that some firms are making acquisitions to boost specialty capabilities. Blacktop outsources marketing duties such as behavioral targeting and media buying and works outside the AOR model.

“Every marketing dollar is still being scrutinized, so for agencies to not only have efficiencies but specialization is also important,” he said. “Brands see the appeal in highly specialized firms because they can tap into additional resources as needed.”

In terms of comparing this year to 2009, Mann said that many companies will look at last year as a “throwaway year,” similar to the 2001 and 2002 dot-com bust.

“So, 2010 is the year to really get your numbers right,” he added. “This year companies are able to hit the financial reset button and move forward with confidence.”