Few industries rely as heavily on traditional direct marketing channels as financial services, especially for lead generation and customer acquisition. The result is that many households — especially those with good credit or who have recently made a large purchase — are inundated with mailers, phone calls and e-mails for credit cards and other financial products and services.

But the combination of tougher credit standards by financial services companies and the increasing use of do-not-contact options by consumers is slowly shrinking the prospect pool, forcing many marketers to reexamine how to connect with consumers.

“I wouldn’t say [marketers are] at the crossroads yet, but they’re rapidly coming up on it,” notes Luc Bondar, VP of global loyalty marketing at Carlson Marketing, a marketing services agency with a variety offinancial services clients.

None of this will have an immediate impact on the direct market channels being used by financial services firms, but marketers are now aggressively looking for ways to get the same response rates with smaller lists. Patrick Surry, technology VP for direct marketing analytics and technology company Portrait Software, which offers solutions for financial services firms, explains that companies are getting smarter about targeting.

“They’re able to figure out in advance which customers a message will likely have the most positive impact on,” he says.

But even as financial companies work to make their direct marketing more efficient, credit-worthy consumers have grown so immune to traditional direct mail and phone calls that the challenge is getting them to even open an envelope or e-mail, notes Pamela Lockard, president of Dallas-based direct-marketing firm DMN3.

“The current flavor of the day is what I call ‘blind mailings,’ where there’s no identification on the outside of the envelope to indicate it’s a credit card or financial offer,” she says. “The feeling is maybe you can get the consumer to open it rather than trashing it based on the envelope.”

But going forward, the better trend may be an increased emphasis on lifestyle affinity marketing. For example, DMN3 is currently working with American Airlines Federal Credit Union on a rewards program that leveraged the members’ interest in travel and proved more compelling than asking a customer to make a decision based on a short-term APR.

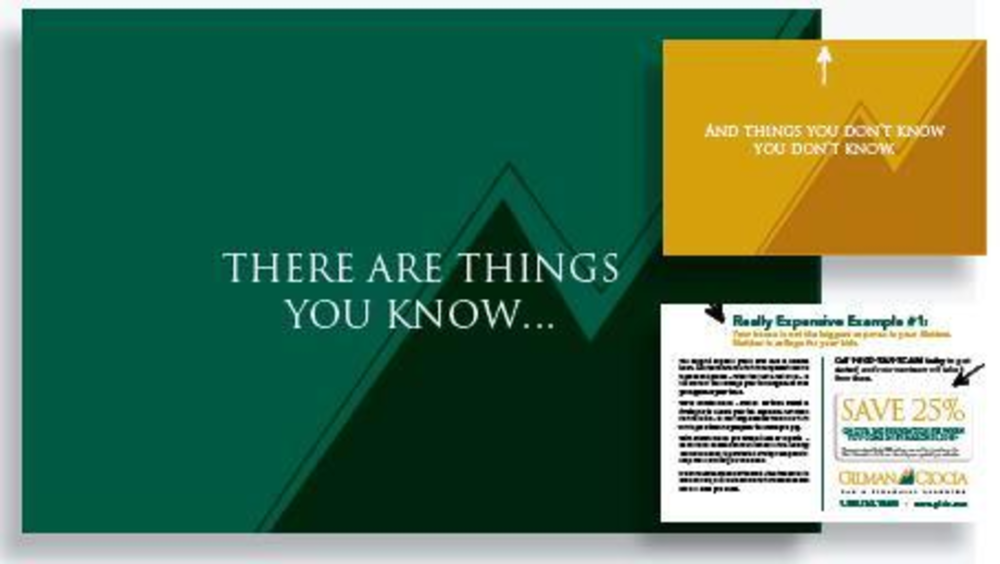

The challenge for marketers is rising above the clutter when customers face so many confusing messages. One way to get heard amid the cacophony of financial service noise is by investing in higher-quality mailers that can separate your message from the pack, says Chris Clews, marketing director with tax-financial firm Gilman Giocia.

In addition, given that they always been somewhat sophisticated in their approach to analytics and testing, financial services companies are using more online tactics, like search engine optimization, Web sites and interactive ads. But Ty Thornhill, VP/management supervisor for Erwin-Penland, which is currently working with Wachovia on a retirement planning e-mail and Web campaign aimed at women, cautions that financial marketers can’t assume new technologies will answer all their questions.

“It’s always going to be a question of relevance and that means targeting and content,” he says. “We have to give [customers] something that’s worth it, whether it’s entertainment value, story value or information that helps them live their lives.”

American Airlines Federal Credit Union: Direct mailer

This third quarter 2007 campaign run by DMN3 for American Airlines Federal Credit Union (AAFCU) proves that the right robust offers aimed at a very targeted audience — in this case, a free program rich with travel points and rewards, in addition to a 0% introductory rate — can still cut through all the credit card mailers consumers receive. The mailer response rate outperformed AAFCU projections by 139%.

Wachovia: E-mail campaign and Web site

Launched in 2007, the ongoing Wachovia for Women program tells the story of six women at different stages in their lives and how they’re preparing for retirement. “We wanted to make sure we were giving women digestible pieces of information that is interesting to them andrewards them for reading it,” explains Ty Thornhill, VP/management supervisor for Erwin-Penland, which worked with Wachovia on the campaign.

Gilman Giocia: Five-panel mailer

Tax/financial planning firm Gilman Ciocia incorporated this five-panel mailer into a campaign aimed at getting people to think differently about tax season. The campaign’s assets were all tagged with the 1-800-TaxTeam phone number and many also invited consumers to go the company’s Web site, where they could quickly sign up for a 25% off coupon for tax preparation.