Although there’s been talk by retail watchdogs that this holiday season’s discounting might not be what it was in past years, Amazon.com, Wal-Mart, Target and Sears are racing to the lowest prices on book sales.

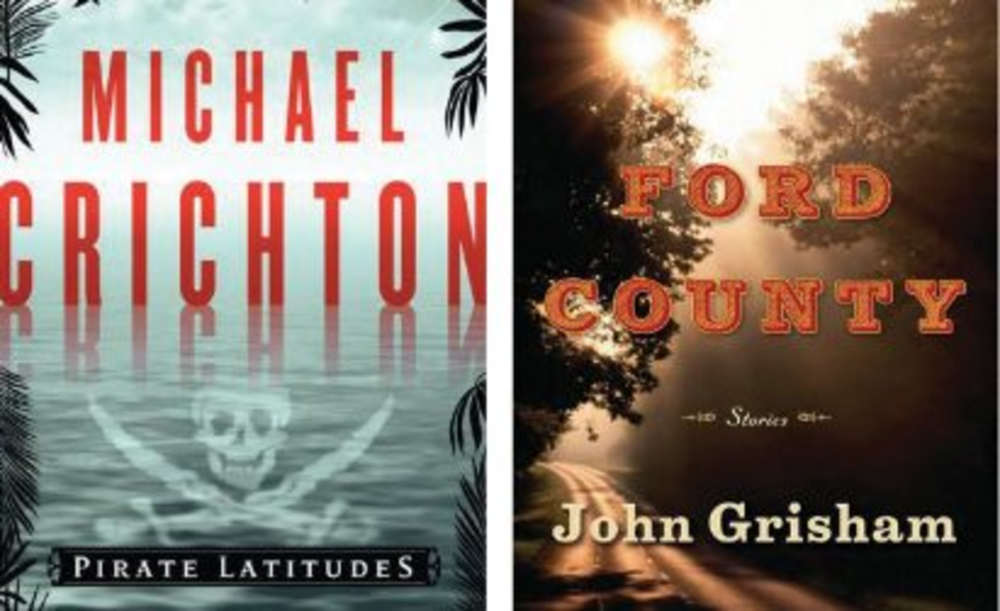

The book price war started earlier this month when Wal-Mart lowered the price to $10 on pre-orders for several upcoming releases. Amazon.com quickly responded by matching this price. Wal-Mart then cut the price again, and Amazon followed suit. Target also slashed prices. As of press time, prices at those retailers stood at about $9 for hardcover books such as Michael Crichton’s Pirate Latitudes and John Grisham’s Ford County.

Wal-Mart announced at its annual meeting this month that it will focus on offering the lowest prices to consumers this holiday season.

“Multichannel players like Wal-Mart and Sears are making serious efforts to try to acquire new customers online and pose a viable threat to Amazon.com, which they haven’t done historically,” said Sucharita Mulpuru, VP and senior analyst at Forrester, via e-mail. She added that retailers can attract consumers with books because of its popularity as a category. Online book sales were up 18% in the second quarter year-over-year, according to ComScore.

Sears is taking a slightly different approach. Consumers who buy one of the 10 discounted books on at Sears.com, Walmart.com, Amazon.com or Target.com can get an online credit equal to the book’s sale price for use at Sears.com.

“We saw the price war between Amazon, Walmart.com and Target and came up with an incentive that we felt gives more to our customers,” said Tom Aiello, Sears spokesman, in an e-mail to DMNews. “In doing so, we give customers more value and introduce them to some of the unique offerings at Sears.com.”

Sears’ incentive is set to run through November. The company is promoting it through Sears.com, social networks and other digital assets, said Aiello.

Retailers are also more likely to compete on book sales, rather than high-priced consumer electronics, for instance, because they are relatively inexpensive from the merchant’s perspective. “It’s cheaper to compete on books than an HDTV,” Mulpuru noted.

Large retailers can also compete with specialized book-sellers because, ultimately, they offer much more than reading material. These general merchandise sellers “offer books but, media isn’t the bulk of their business these days,” said Michael Norris, senior analyst at Simba Information.

However, he added that specialty stores can offer additional value beyond a low price. They “can’t compete on price, but the value of what they provide is beyond pricing,” said Norris, pointing to the readings and other community events held at many book stores.

“The impact that Amazon, Target and Wal-Mart have is to take a group of consumers out of these retailers’ orbit,” he added

Book chains like Barnes & Noble and Borders are often aggressive on pricing, but not to the same level that large general retailers are. A recent check showed Barnes & Noble was offering Pirate Latitudes for $16.79 online.

However, many bookstores are fighting back by creating intricate digital strategies, Norris added. Many smaller stores also establish presences on on Facebook and Twitter as well, he noted.

“Booksellers, particularly independent ones, have done a good job making the value-add they offer about their stores and more than just buying the book,” Norris concluded.