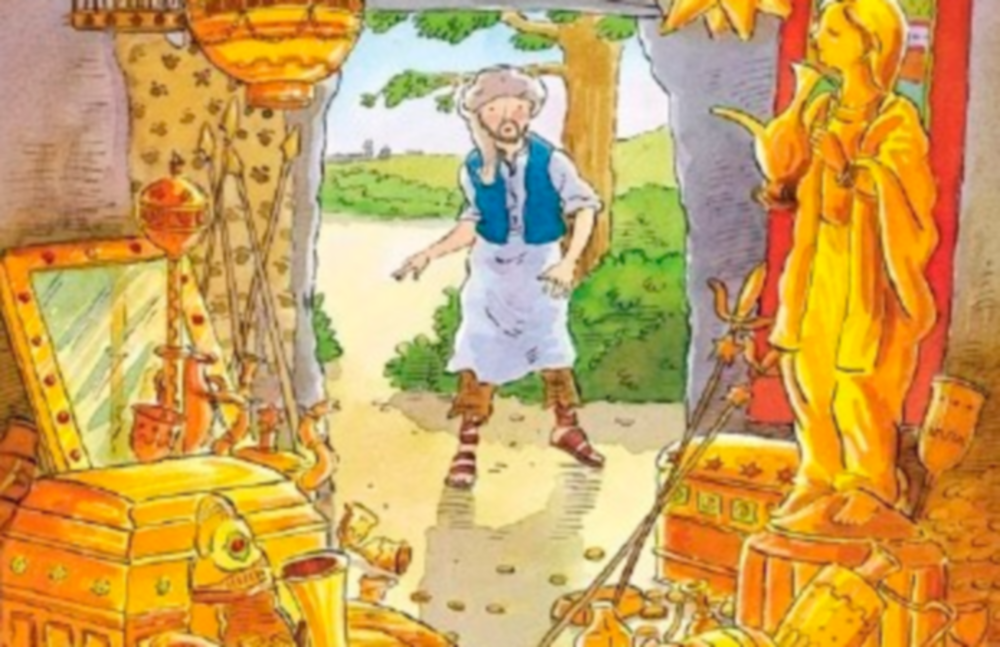

In the famed story of Ali Baba and the Forty Thieves, Ali Baba, a poor villager, spies the captain of a troop approaching a hill and bellowing, “Open, sesame,” at which point a door opens, revealing a cave full of money and merchandise. When the troop leaves the cave unattended, Ali Baba approaches, repeats “Open Sesame,” enters the cave, and absconds with as much gold as his asses can carry.

Another Alibaba, the Chinese e-commerce giant that has its hands in some 80% of online sales in the world’s second largest economy, today concludes a global road show hyping its IPO on the New York Stock Exchange. Unlike his company’s namesake, Founder and Executive Chairman Jack Ma is hardly poor. He and a few dozen other original employees control most of the company’s stock, and they’re out to make it a global business. The aim of the road trip is to nudge the initial offering price of Alibaba stock into the $66 to $70 range, which would give the company a market value of about $22 billion and make the IPO the biggest in history.

Amazingly, however, e-commerce and marketing industry veterans pooh-pooh the thought that Alibaba might actually take root in the U.S. and challenge Amazon and eBay, which together do not equal the Chinese merchant in goods sold. They say Americans don’t know Alibaba, that the company’s business model is untested here. “The wise thing would be to start small, investigate the market, investigate the consumers, and investigate the competition and try and build a model that is attractive to Americans,” sniffed WPP chief Martin Sorrell to the British publication Daily Finance, sounding as if he were patronizing a wet-behind-the-ears Harvard student over his crazy idea to launch a version of a college freshman’s facebook on the Internet.

True, Alibaba does not actually sell any merchandise, like Amazon does. But maybe that’s a good thing. It makes the bulk of its money—like Google—from advertising and from brokering sales on its online marketplace Taobao and through its payment service Alipay. In the quarter ending June 30, Alibaba banked profits of $2 billion on sales of $2.5 billion. During the same period, Amazon lost $126 million on sales of more than $15 billion. Could it end up that handling all that merchandise is a chink in Amazon’s armor? Will Amazon, ultimately, be the Internet retailer with the faulty business plan?

At his road show event in Hong Kong on Monday, Ma said he planned aggressive expansion in the U.S., and why not? Even if his business plan performs only half as well in the U.S., his return on revenue will be 40%.

One digital marketer thinks the Chinese import could shake up the status quo in the States. “For all the competitive disruption here in the U.S., with new companies springing up every day, it still tends to be a lot of the same venture capitalists and the same vetting organizations,” says Erik Severinghaus, CEO of SimpleRelevance, which offers personalization services to Internet retailers. “There’s a fairly well-established process and pipeline for how this innovation happens. As Alibaba advances into America, there’s going to be a lot of hand-to-hand combat.”

And let’s not forget the smartphone-wielding folks who are purported to have all the power in the consumer marketplace, that being the consumers themselves. Granted, when they have a yen to buy something, some 45% of them go immediately to Amazon, according to a survey released this week by Market Track. But as loyal as the throng may be to America’s current king of Internet commerce, they’re even more loyal to an age-old ideal: low price. More of them (48%) go to a search engine first when shopping for a product, and 72% said they compared prices on three or more websites before deciding where to buy, according to the study.

“Alibaba could offer more options to shopper and give them more control than they’ve ever had in price,” says Traci Gregorski, Market Track’s VP of marketing.

For years, Wall Street has indulged Amazon’s habit of reinvesting profits into new businesses and low prices, but year after year of negative earnings has investors getting impatient. Alibaba, foreign as it may be to American consumers and business practices, packs a lollapalooza of a one-two punch: low prices and huge profits. That’s a language that all investors, no matter where they’re based, understand.