Under pressure to prove the ROI of their initiatives, most marketers today prefer to measure success in numerical results, such as clicks, conversions, and sales. But there’s a deeper—and equally valuable—way to measure whether marketing efforts have performed well: qualitative insight. “Both are valuable and serve distinct purposes,” says Cesar Melgoza, CEO of intelligence platform Geoscape. “Deeper insights are yielded by qualitative approaches; whereas larger, more mathematically precise insights are yielded through quantitative approaches.”

In this Q&A, Melogoza breaks down when qualitative measures add value to the hard numbers and how to find the delicate balance between the two.

Marketers often gravitate toward quantitative measures. What can qualitative measurements provide that quantitative can’t?

Marketers use both qualitative and quantitative measures. However, quantitative [is] more tangible and less subjective… more measurable and concrete. Marketers can apply percentages and other numeric values and calculate statistical significance of quantitative studies. Qualitative [inputs] are summarized by a moderator into overall observations and interpretation, which is less conducive to precise measurement.

Qualitative studies provide deeper insights that are nuanced, [deep-seated], and are less subject to mathematical analysis. They can be responses to offers or product designs and can be used to compare and contrast different options. A survey normally is a response to a questionnaire without the addition of an image or presentation of a product or service. It can be an open-ended question, where there respondent fills in the response, or can be a multiple choice or ranked responses.

So, how can marketers infuse qualitative measurements into their campaign goals?

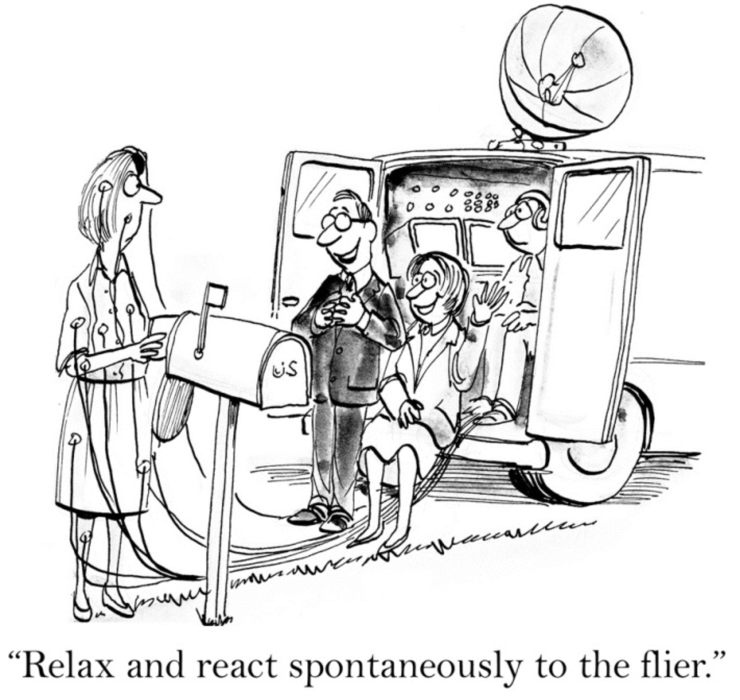

Given the investment in rolling out a new product, service, or ad campaign, it makes sense to get tangible input from consumers you expect to offer the product to. This process will help you refine, adjust, or completely change your approach within a test group before you spend huge funds trying to connect with large groups of intended buyers. Specific reactions will enable you to optimize the campaign prior to spending the big budget—potentially avoiding a disaster and helping to ensure success. It’s good practice to do your homework in advance, as opposed to simply flying from the seat of your pants.

How should qualitative data inform a marketing campaign?

Imagine spending millions of dollars on an ad campaign that your agency developed, but which hasn’t been tested. You’re being…judged by management on the results or ROI. If you get lucky, and it works well, good for you. If it doesn’t, you’re in big trouble.

It’s important to make sure you do [qualitative data gathering] properly: carefully selecting the subjects, or people, to reflect the intended, ideal, and targeted consumer; asking the right questions; plus, choosing a firm and a moderator. This may be more expensive in the short run, but we all know the saying: You get what you pay for. Or, as my mother taught me from an early age, “Lo barato sale caro.” That translates in English to, “What’s cheap ends up being expensive.”

Which channels deliver the best qualitative data?

Actually, social media listening can yield qualitative information that is often quantifiable given the potentially large number of responses. This is a hybrid approach that can be made more rigorous through data enrichment. That is, if you append certain standard demographic and economic attributes to the respondents on social media, then you can enhance the reliability of this data. I believe this will evolve into a strong trend going forward.

How do marketers find a balance between quantitative and qualitative results?

Normally, you’ll want to do both types of work. But sometimes qualitative can be sufficient, depending on the goals. These approaches can be extended into what’s known as conjoint analytics, which enables you to perform trade-off studies that help you fine tune the combination of offer, creative, price, and product attributes. Ultimately, you’ll want to make the right offer to specific consumer sub-segments using the right messaging, creative, channel, or medium. The bigger the stakes, the more important it will be to do the right reconnaissance.