With bricks-and-mortar stores delivering some of the worst sales performances in decades in October, a new crop of shopping search engines, including Toys.com and iStorez.com, which officially launches the week beginning November 10, are hoping to reverse the numbers by offering enhanced experiences for consumers and unique cost structures to retailers.

“The good news is that [online retail sales] growth will outpace nearly every other sector of consumer spending” during an otherwise lean holiday season, said Sucharita Malpuru, a principal analyst at Forrester Research, in an e-mail to DMNews.

While the most recent predictions expect holiday sales to be flat or fall by a percentage point or two, more than 56% of online retailers expect holiday sales to increase at least 15% from the same period a year ago, according to the 2008 eHoliday Study conducted by Shopzilla for Shop.org.

People are more comfortable buying products online and becoming more so all the time as they get used to how quickly they can access information via the Internet and their mobile phones, said Chip Arndt, co-founder of MerchantAdvantage, which manages retailers’ shopping engine data feeds.

Arndt, who recently counted 279 shopping sites on the Internet, noted one trend: the recent launches of more niche-oriented shopping sites.

It is against this backdrop that The Parent Company and Kriyari Inc., which operates IStorez, are launching new shopping engines this week. Another recent launch, Greenzer.com, focuses on eco-friendly items.

“What’s happening is that comparison shopping engines are morphing into consumer shopping engines,” where the focus is more on delivering a consumer-driven experience, said Arndt.

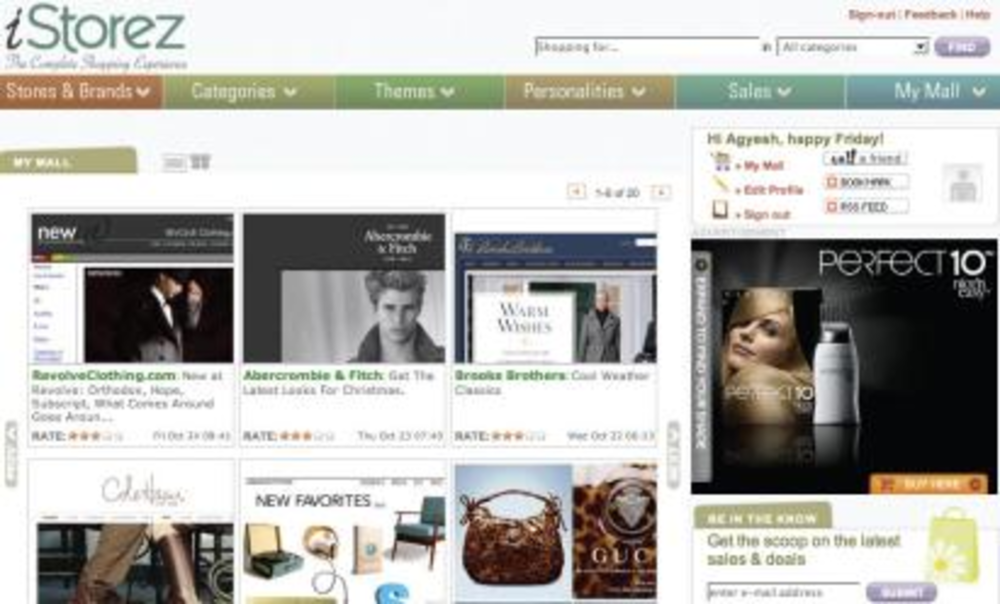

IStorez.com, which launched in beta earlier this year, offers users the opportunity to create a customizable profile enabling them to browse by categories such as personality type, color, fabric and theme. This is in addition to more standard features such as the ability to browse by brand to view any promotions and click through to a selected brand’s site to make a purchase.

The company also has a deal with Westfield, one of the largest retail property groups in the world, under which customers have the option of ordering something online through an iStorez affiliate brand and picking it up at a local Westfield shopping mall. IStorez products also are featured in Yahoo Shopping searches. It has cost-per-click agreements with 25 brands, and 300 cost-per-action affiliate partnerships.

IStorez “creates for the consumer a dynamic personal mall,” giving the site a unique appeal that will hopefully make it a destination for shoppers, said Anand Jagannathan, CEO of Kriyari. The click-through rates have been 69% in beta, with a high browse-to-buy conversion rate, he added.

The Parent Company, which operates BabyUniverse and eToys, is launching Toys.com this week as a shopping comparison site for toys. Users can search by item and will see results showing the different retailers offering what they’re looking for. The company hopes to add features, such as a centralized wish list, across multiple retailers, product reviews and social networking in the future. The launch will be supported with a search marketing program.

“All of these sites basically do the same thing, so it’s becoming a branding game,” said Arndt. He added that features like social networking and product-related content are being used to make these sites destination spots for consumers. With so many players in the field, he expects a shakeout with the winners being determined by who can pull traffic that is interested in buying.

What also makes several of the more recent shopping site launches unique is that instead of offering retailers a pay-per-click cost structure, they have a hybrid of cost-per-click and affiliate arrangements.

“Shopping sites have priced themselves out of the market” with expensive cost-per-click programs, said Michael Wagner, president and CEO of The Parent Company. Toys.com uses a combination of affiliate marketing pay-per-performance and cost-per-click structures.

At launch, Toys.com will have the participation of “all but one of the major toy retailers,” Wagner said. To keep the search engine independent of the eToys retail business, the company is using Channel Intelligence to manage data feeds and the revenue collection.

A lot of retailers are dissatisfied with existing cost-per-click payment fees, said Arndt. However, “it doesn’t really matter how you work the cost structure of a shopping engine,” he continued. This is because a good analytic tool will enable retailers to get a handle on whether a shopping engine is attracting customers who are buying from them or not.

“I have one client who does extraordinarily well on Nextag and another who doesn’t,” he explained, adding that not every shopping engine is going to work for every retailer.

The Toys.com launch is one of several recent Parent Company initiatives following last year’s merger with BabyUniverse. The firm also recently revamped its eToys.com Web site, adding more promotions on the homepage, giving shoppers more ways to search and testing advertising for the first time.

The company has shifted its marketing mix to support the brand, mailing 40% fewer catalogs in September and investing those dollars into new customer acquisition programs online in November.

“Because of the seasonality of the toy business, the number of impressions we can deliver during the holiday season is huge,” Wagner said.