Third-quarter earnings for the “big four” advertising holding companies were dismal year over year, yet experts queried by DMNews painted a rosier picture for digital advertising — because it shows ROI.

“We’ve seen when the economy starts to tank, that it’s hard to justify spend that doesn’t directly correlate to revenue growth,” said Gard Gibson, partner and executive director of strategy and innovation at WPP-owned agency VML. “It’s very hard in traditional marketing to achieve that.”

Overall revenue was down 5.3% at Publicis Groupe, organic revenues dropped 14.2% at Interpublic Group and worldwide revenues fell 14.4% at Omnicom. WPP Group saw a 7% rise in revenue, thanks to last year’s acquisition of market research firm Taylor Nelson Sofres. Not counting gains from that deal, WPP’s Q3 revenue fell 9%.

Digital continues to draw more attention from corporate chiefs for the amount of revenue it’s gaining. For the first nine months of 2009, digital communications accounted for 21.3% of Publicis’ consolidated revenue, up from 18.5% in the same prior-year period. Following the company’s earnings report, Publicis Groupe chairman and CEO Maurice Lévy told media that his goal is to transform Publicis into an all-digital agency.

At WPP, revenue from direct, digital and Internet represents 26%, or $2.6 billion, of the company’s revenue this year. Revenue for the holding company’s healthcare and specialist communications segment, which includes direct marketing, and interactive, reportedly dropped 9.6% during the third quarter. IPG and Omnicom did not break their numbers down by channel.

Dave Frankland, principal analyst at Forrester Research, said the economy accelerated the shift from traditional to digital channels that had already begun.

“In the next few months to a year, we’ll see more of the same,” he said. “Mobile and social media are all the rage.”

Frankland hopes conversation about which individual channel is best will cease in favor of a more customer-centric viewpoint. Marketers, he said, should ask who their most valuable customers are, who’s most likely to respond, and what the best way is to reach them.

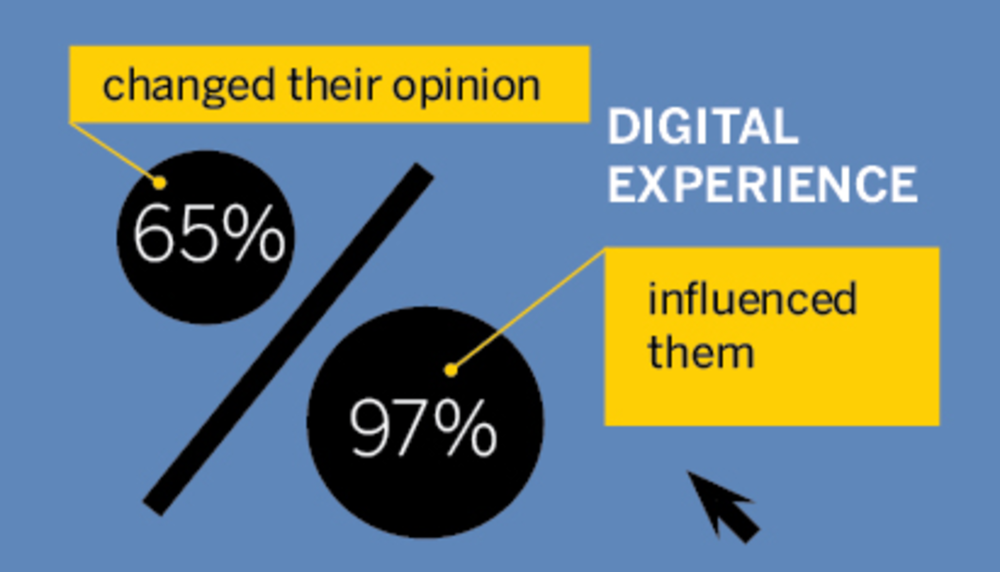

Statistics support digital’s outlook as well. According to the 2009 Razorfish Digital Brand Experience Study, 65% of consumers report having had a digital experience that changed their opinion about a brand. Of that group, 97% say that their digital experience influenced whether or not they eventually purchased a product or service from that brand.

“The realm of the digital experience has really opened up in terms of where consumers play now,” said Garrick Schmitt, group VP of experience planning for Publicis-owned digital agency Razorfish. “Everything consumers do now — research, talking to friends — is all done digitally, so for brands to not have a significant presence there and be a part of the conversation, they’re really missing something.”

While the ailing economy plays a role in revenue declines, marketing executives say now is a prime time to reach consumers with response-driven buys.

“The timing and size of impact of the response is most important,” said Peter DeNunzio, president of IPG-owned Draftfcb’s New York office. “This is leading clients to direct and digital marketing with more frequency than they might have before when the economy was booming.”

According to Forrester Research’s US Interactive Marketing Forecast, 2009 to 2014, 60% of marketers said they will increase their budgets for interactive marketing by shifting money away from traditional channels, such as direct mail, print and broadcast ads. Gibson added that although some clients may not be adding to their interactive budgets, they’re doing much more to protect those dollars than the traditional marketing spending.

“The fact that I can turn around and say, ‘If you spent X, this many people were exposed, this many people interacted, this is how long they spent and what actions they took [is powerful].’ I’m not going to be telling you only how many people saw the ad,” he said.

Digital initiatives are not as cost-intensive as traditional media and can give consumers more content with which to interact, Schmitt added. Marketers no longer need to “cram everything into a 30 second spot,” he noted, because they now can create an entire digital experience.

“That’s a much more significant driver for sales and Web traffic,” he explained.

“It’s one of the truisms of media investment,” added DeNunzio. “As more customers live online and make use of the online channel for e-commerce, communication and social media, advertisers are going to follow.”

Jeff Orr, a senior analyst at ABI Research, predicted that in North America alone, $650 million will be spent on mobile marketing this year. That’s up from $300 million in 2008. He predicts that number will jump to $4 billion in 2014.

“There’s been a significant shift in media channels and many new entrants when it comes to technology,” Orr said. “Each company has to assess how to embrace the mobile and digital channels.”

The diminishing clout of print publications means a decrease in options for traditional ad sponsorships, he added, so media companies will embrace more mobile and digital advertisers.

“Now is a great time to see what mobile can do for them,” he said. “Today every company has to be willing to consider [mobile marketing] and decide if it makes sense.”