The Online Publishers Association threw down the gauntlet with a study released August 13 that questions the advertising effectiveness of ad networks and portals. As one ad network executive, Burst Media CEO Jarvis Coffin, put it, OPA “opted to set fire to the forest floor that … scorched the effectiveness of the entire Internet as a brand medium save for its 50, or so, members.”

The OPA study claims advertising placed through ad networks and portals generated the smallest change for branding metrics, and in some cases made no difference.

“Not all inventory is created equal,” said Pam Horan, president of OPA. “Different environments produce different results.”

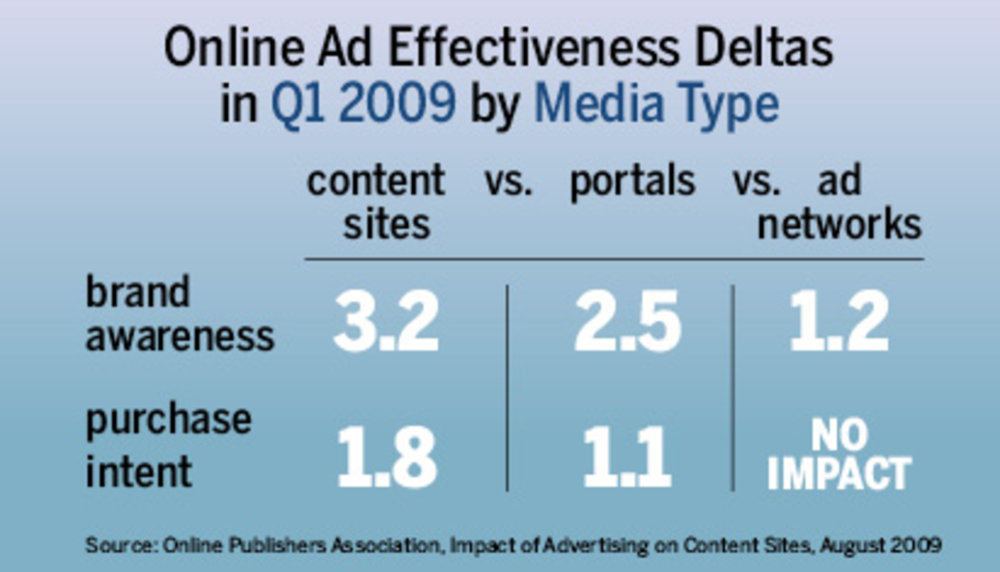

Ad effectiveness scores on member content sites were numerically higher than ads placed on portals or ad networks. The findings are based on Dynamic Logic’s MarketNorms ad effectiveness data, and includes a global database of 5,000 campaigns and 7 million respondents.

But ad networks say this study is missing the point, suggesting there is a place for both ad networks and premium pricing. Many brands purchase premium content on publisher sites and fill in the blanks with remnant inventory.

MarketNorms calculates the average performance of all online campaigns on branded content sites, portals and ad networks.

The findings show that ads on OPA member sites were consistently effective in raising awareness, creating message association, generating brand favorability and driving purchase intent over portals, ad networks and the overall MarketNorms average.

In addition, online ad awareness metrics were 21% greater for ads on content sites than portals, and 50% more than ad networks; and purchase intent was about two-thirds higher on content sites than portals, and nine times that of ad networks. The study also found that video ads on content sites represented by OPA members have the greatest impact: purchase intent was 163% higher than overall MarketNorms data and 93% more than portals.

Some executives find the OPA study too simplistic. An investment banker and former online ad executive said, “I think the OPA is right at an oversimplified level, but the study ignored some pivotal factors. One is cost and the other is how skillfully one buys networks. A network will happily run many of your impressions on the cheapest & lowest value sites if you don’t know what you are doing.”

He added that premium content sites fall short of delivering the results commensurate with their premium price. “The OPA content sites are a lot more expensive and should deliver better results,” he said, concluding that “the study is a bit superficial.”

The contrast is stark, asserted Bruce Rogers, chief brand officer at Forbes. “This is about premium content with premium pricing vs. low prices devoid of content and context,” he said. “[The study findings] show advertisers why it makes sense to advertise in a premium environment.”

But John Ardis, VP of corporate strategy at ValueClick, disagreed with Rogers’ point of view. “To suggest that there is a different kind of experience is kind of missing the point,” he said. “What networks provide is a cost effective way to provide near real time business results and to allow their ad appear on a handful of sites across the Web.”

Not surprisingly, advertisers use both premium ad placements and network buys. “If an advertiser is doing more of a branding campaign, it will probably go to more name brand properties,” Ardis said. “They tend to spend as much as they can afford on the well-known publishing properties and… the rest on remnant inventory to get reach.”

Many publishers sell their remnant inventory through ad networks. “Many of the networks do have some of the same types of inventory as these publishers,” said Dave Moore, founder/chairman of 24/7 Real Media. “Some of the members of the OPA outsource a significant amount of their inventory to networks, so to say that there was a 21% difference in effectiveness is surprising.”

Indeed, media agencies tend to buy across various ad networks and select premium media to make sure that they are getting a little bit of everything.

For example, in a campaign that Neo@Ogilvy did for the American Red Cross this past spring, the agency ran ads on more well-known sites, such as MenuPages, HopStop, Fandango, Bloomberg.com and NYMag.com, as well as lesser-known sites, to help reach their target audience across the Web. It worked with a slew of ad networks including AOL’s Platform-A, InterClick, Burst, Gorilla, Tribal Fusion and ValueClick, to make the reach as wide as possible.

Laura Scala, partner, group planning director, media Neo@Ogilvy, told DMNews that using ad networks helped get the best bang for their buck.

“In some cases, it is a gray area, and you might just use both. They do work in concert with each other,” Scala said.

For their part, ad networks have been evolving their tracking and adding tools such as contextual, behavioral and geographic targeting, as well as offering vertical ad networks based on specific industries to improve effectiveness.

“There are a host of networks that focus on adding value beyond supply aggregation in the equation that will not only exist, but thrive and grow,” said Michael Katz, founder and president of ad network InterClick, via e-mail. “It’s naive to underestimate networks, which tend to be hotbeds for innovation. And it’s instructive that the largest agency holding companies are all building networks.” l