For years, many C-suite executives, including some marketers, have grudgingly looked upon database management as a necessary but boring and decidedly un-sexy function; an activity viewed with about as much excitement as cleaning and organizing the family garage. But in this extraordinary era of bailouts and budget cuts — and given the need to squeeze value from every company asset — more companies are looking to database management as an in-house financial stimulus tool.

As the 2009 DMNews/CognitiveDATA Data Management Survey points out, marketers across the country are focusing more closely on data collection, quality, accuracy and storage, especially when such efforts can bring direct mail costs down and offer better targeting opportunities across channels. One top marketer says companies have finally begun to realize customer data is like “liquid gold.” Could it be that in this time of economic challenge, respect for and value of data management will, rise to all-time highs?

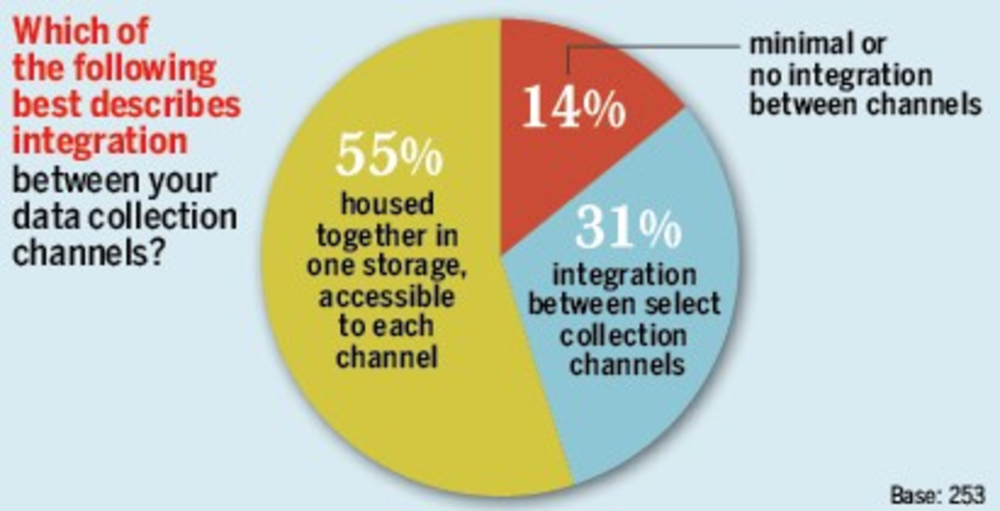

Before they can begin to mine these potential riches, however, companies will need to overcome some obstacles — including some old-fashioned thinking uncovered in this year’s study. Conducted in early April 2009, a total of 253 respondents took part in the survey, including top company and marketing executives, directors and managers from across the US. A full spectrum of industries was represented, from financial services, technology, retail and catalog to business services, healthcare and pharmaceutical, as well as industrial and manufacturing sectors. All maintained either an in-house client database, a prospect marketing database or both.

Annual revenue for the surveyed companies was fairly evenly split: 48% reported annual revenue of $100 million and less; 52% said their companies generated more than $100 million annually. About 55% reported their in-house database held fewer than 1 million names, while 45% said they maintained databases in excess of that figure.

Click here to continue reading this article