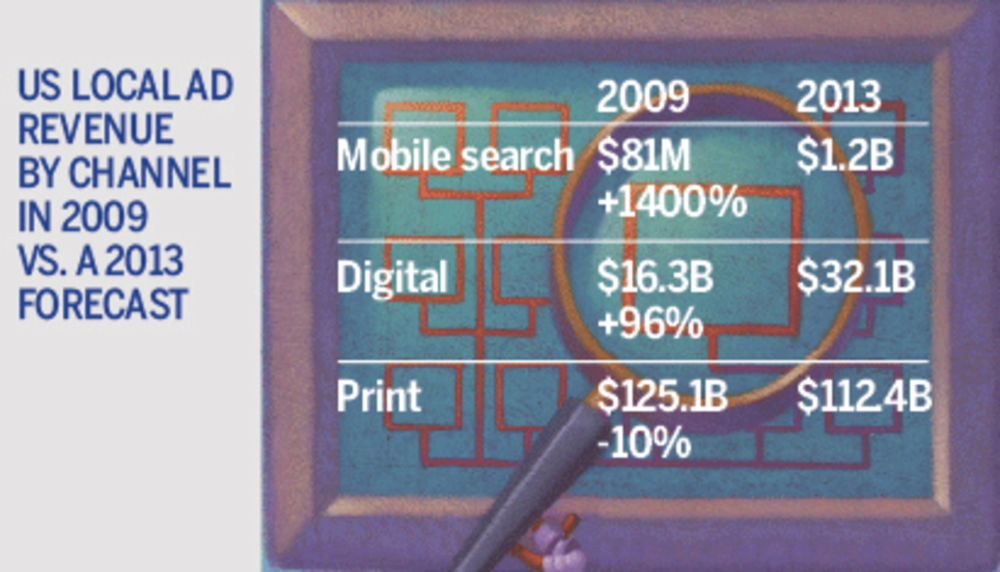

According to The Kelsey Group’s Annual Forecast, local advertising is shrinking. In 2008, the market size of the US local media and advertising market was estimated at $155.3 billion. By 2013, that number is expected to be only $144.4 billion. As money dries up from traditional local media like newspapers and the Yellow Pages, local ad money shifts into mobile, search and social networks.

“We are seeing a shift as the overall local ad media pie shrinks over the next five years,” said Michael Boland, senior analyst at The Kelsey Group. “While there will not be a lot of growth in local advertising, we are seeing a big shift from traditional media to channels that are more measurable, so we are seeing money move into search and into mobile as well.”

Kelsey notes in its Mobile Local Media 2008-2013 study that the US local share of mobile searches for local services is expected to grow from 27.8%, which was seen in 2008, to 35.1% of searches by 2013. And, ad revenue from local mobile search is expected to grow from 50.3% of revenue seen in 2008 to 56.1% in 2013.

For AT&T’s Yellowpages.com, mobile local search application is pre-loaded onto millions of devices. Last week, the firm launched an updated Yellowpages.com app for the iPhone. “Mobile search tends to be focused on local — most searches today are for a specific business and almost a third is for business by category,” said Jenny Bridges, a spokesperson for AT&T.

Another firm taking advantage of the growth in local mobile advertising is Media Networks Inc., a division of Time Inc. It recently launched a geo-targeting service that delivers ads based on mobile users’ ZIP codes.

“Local advertisers are looking more at ROI and really reaching more guys in their market than ever before, and mobile really offers that ability,” said Matt Fanelli, director of digital media at Media Networks. “Digital ads are very fluid. They can be changed based on the engagement and click-through rates. You can add in a call to action in the middle of a campaign.”

Media Networks is working with mobile sites that collect ZIP codes from users. These sites include those where users are searching for local weather or movie times, such as AccuWeather, MovieFone and Fandango. This user data is then used to deliver ad impressions based on a user’s location.

“Our contention is that as we see more search volume, local is going to account for a great deal of that,” added Fanelli.

But it is not just about mobile search that is finding targeting on a local level to work. For Daniel Ellis, founder of Tenant Txt, a new company that lets property management companies keep in touch with tenants via the mobile phone, e-mail and Twitter, local mobile advertising makes sense too.

With the service, tenants can set up preferences on how they would like to receive alerts about work being done on their building, other units available for rent and even emergency situations, such as robberies or natural disasters in the area.

Ellis founded the firm after Hurricane Ike forced him to evacuate his home — and poor communication with the property management company kept him out of his home for three days longer than necessary.

“It would have been helpful for apartment management to get the word out,” said Ellis. “Text messaging and e-mail helps them get the word out quickly without having to visit each unit. It is about speed and efficiency.”

However, the mobile phone is not the only newly popular local marketing channel. Will Scott, founder of Internet marketing company Search Influence, points out that his company, which specializes in working with small and midsize businesses (SMBs), is actually seeing more interest in localized social media than in mobile search.

“The ability to localize in social seems to be a pretty interesting area for SMBs to try out, and we’re seeing them start to engage in social media and figure out how to do so in an appropriate, non-spammy way,” says Scott.

He adds that, though the Safari browser on the iPhone is gaining traction, traditional, Web-based search still drives the majority of traffic to clients’ sites.

His explanation for the lag in mobile search adoption is that many Americans travel by car daily, rather than wandering through shopping districts on foot, meaning they probably do most of their searching at their homes or work before heading out.

The different formats of mobile and traditional search may also be hindering mobile adoption, he says. Because searches on smartphones typically only show the top three listings vs. the 10 you may get on a computer screen, it’s more difficult for any but the savviest small businesses to leverage mobile.

“Interestingly, because people are becoming much more connected to social wherever they go, it may become the bridge between search and mobile,” Scott adds. “What could be better than if you’re walking down the street by business ‘X’, and you can Tweet asking if it is good, and if you have enough local Twitter followers, you can get good responses and maybe even a coupon.”

Still, Boland argues that the benefit of having an iPhone or a smartphone will lead to more local searches for business. Rather than rely on mobile display ads, advertisers need to get more creative with the channel, he said: “It’s a different device and it will require a new way of thinking.”