A new report from Zeno Group gives insights into the social media behavior of venture capitalists and who is likely to influence their investment decisions.

Hoping your startup catches a venture capitalist’s eye? Try LinkedIn, instead of Twitter. And try getting your name in a big media publication.

A new study from PR agency Zeno Group breaks down which social networks VC’s spend the most time on and who is most likely to influence their knowledge about a particular startup or company.

95 percent of the Forbes Midas List – the magazine’s annual ranking of its Top 100 VCs – have a presence on LinkedIn, but only 64 of the Forbes Midas List are on Twitter, and three of those users have never Tweeted.

While using social media is important, the best way to meet a venture capitalist is still in person. Respondents to the Zeno survey rank industry conferences as the most important channel to staying connected to the VC ecosystem, followed by LinkedIn and then Twitter. Facebook, AngelList and Quora ranked significantly lower.

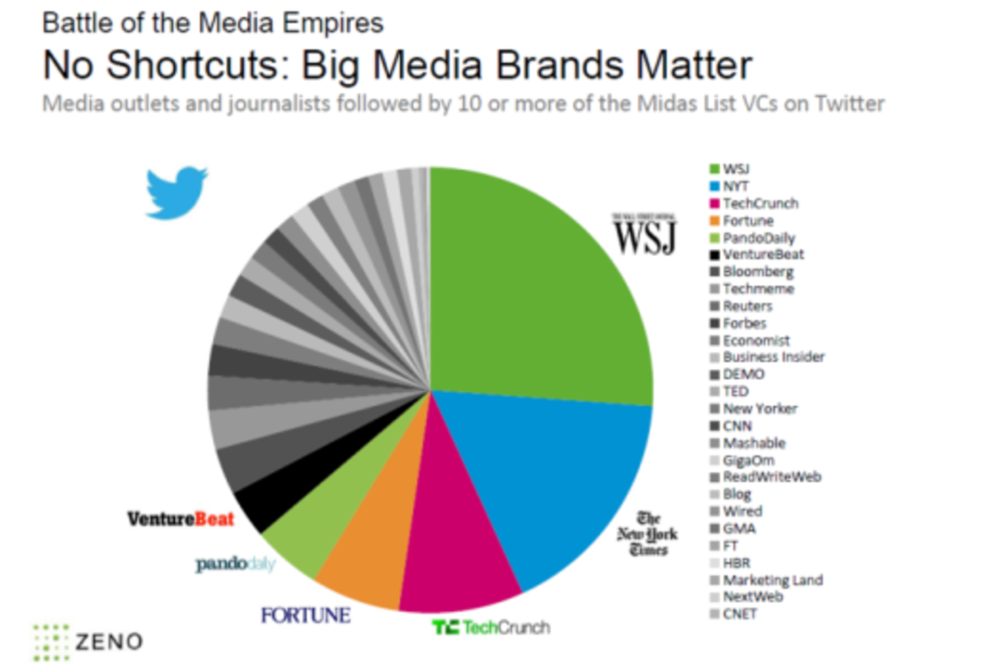

However, if they are on Twitter, venture capitalists are heavily influenced by a few select group of journalists and media outlets. Nineteen percent of Twitter handles followed by top VCs are journalists and media. The most-followed media names by the Forbes Midas List VCs on Twitter are:

– Kara Swisher, AllThingsD – 69%

– Walt Mossberg, The Wall Street Journal/AllThingsD – 61%

– Dan Primack, Fortune Term Sheet – 50%

– Sarah Lacy, PandoDaily – 39%

– Adam Lashinsky, Fortune – 38%

“One of the top requests we get from startups is for help in generating visibility in the media that venture capitalists consume in order to help raise the next round of investment,” said Todd Irwin, managing director of Zeno’s technology practice. “Rapid changes in social networking, the tech media and even the venture industry itself prompted us to take a closer look at the influencers and media who reach venture capitalists.”

Here are the rest of the figures, which make for some interesting findings, if you’re a startup looking to get funding from these guys.