Banishing the ghosts of Facebook’s disastrous IPO last year, Twitter made a flawless debut by going public today, listing on the New York Stock Exchange. Shares opened at $45.10, a good 73% above its $26 IPO price.

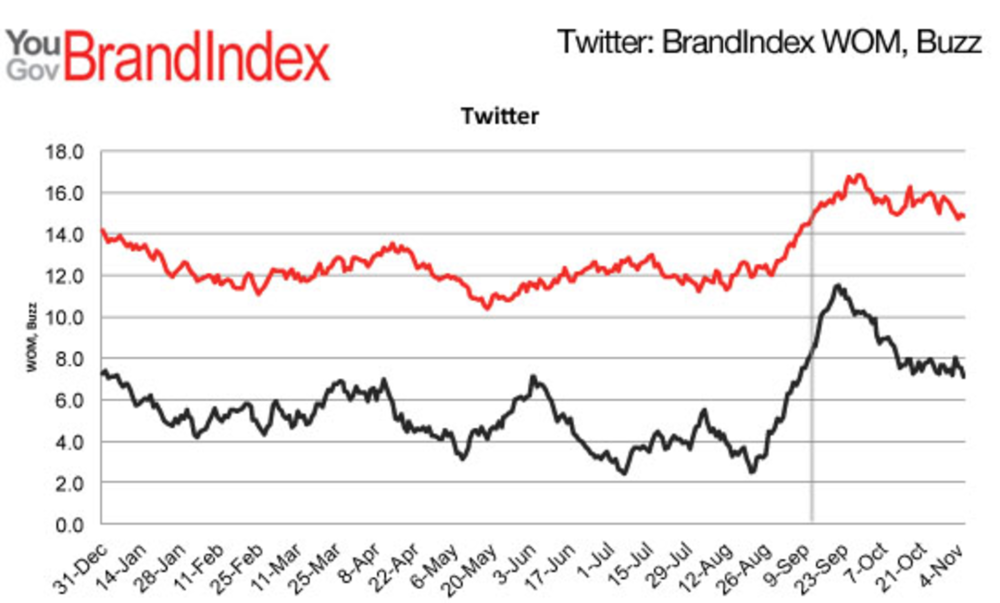

We tracked the buzz surrounding Twitter from the time it announced its IPO plans right up until the day before it went public, using brand monitoring service YouGov.

YouGov collects two types of survey scores, “Buzz” and “Word-of-mouth” (WOM,) tracking them on a daily basis.

Buzz

asks respondents: “If you’ve heard anything about the brand in the last

two weeks, through advertising, news or word of mouth, was it positive or

negative?” while WOM asks

respondents: “Which of the following brands have you talked about with

friends and family in the past two weeks (whether in person, online or through

social media)?”

Here’s Twitter’s performance year-to-date, with the gray vertical line marking when it made its announcement about going public on September 12, 2013. The red line represents WOM while the black line shows Buzz.

It’s pretty striking to see how Twitter’s buzz scores rose so dramatically in the weeks right before and after the IPO announcement, especially between September 10 and Oct 5th. Before that, its buzz scores were the lowest of the year, but as soon as news about a potential IPO leaked out, media presence quickly gathered momentum.

Much of it was due to the tremendous amount of speculation in the press regarding the IPO and what it would mean for the company. It was also around this time Twitter released its financials for the first time, which showed that even though the company was generating a lot of revenue, it had yet to turn a profit, causing another round of speculation.

Twitter managed to sustain the buzz by announcing several updates, partnerships and programs designed to make it more appealing to advertisers. It was a move designed to combat criticism about its lack of profits, and of course to drum up support for the IPO pricing. Notable updates included the addition of push notifications, and the introduction of pictures and video displaying in Twitter feeds. Revenue-centric news included advertising partnerships with TV networks and sports organizations, such as CBS and the NFL. There were also high profile targeted ad partnerships such as this one with Gap.

By mid-October, there was a sense of Twitter fatigue, and the buzz began to taper off/ However, with the IPO looming, Twitter still managed to remain well above the scores it had before the IPO announcement.