A series of changes to the federal student loan program that take effect July 1 could potentially slow the recent dramatic growth of direct-to-consumer loans from private lenders.

The changes to the federal loan program include an increase in the amount students can borrow, a decrease in interest rates on loan repayments and new repayment terms enabling some borrowers to start repaying loans six months after graduation instead of 60 days.

In 1996, 6% of student loans came from private lenders, but by the 2006-2007 school year, that number had grown to 24%, according to the College Board.

After growing at a rate of 27% each year — in inflation-adjusted dollars — for five years, borrowing from nonfederal sources only increased by 6% in 2006, for a total of $18.5 billion.

Much of the growth private student loans have seen in the past 10 years can be attributed to aggressive direct marketing.

“There’s a hot dispute regarding whether or not the direct marketing of [private sector] students loans is in the best interest of students,” said Kevin Bruns, executive director of America’s Student Loan Providers.

Federal loans typically offer lower interest rates than private loans.

“Strictly speaking, federal loans are better, but the direct marketing of loans gets to families first … they often end up borrowing from these programs,” said Mark Kantrowitz, publisher of Finaid.org, a Web site offering student aid information, advice and tools.

The federal government runs the Direct Loan Program, which allows students to borrow directly from the Education Department using the Web instead of taking out federally funded loans from private lenders.

However, direct-to-consumer loan providers do often make a wealth of information readily available to parents and consumers on Web sites.

Borrowers can also apply online and receive an approval moments later, Kantrowitz said.

Due to the July 1 changes, “private loans will go through a temporary slowing,” Kantrowitz said. However, he expects the growth rate will return to 25% next year.

While the government raises the profile of its own lending programs, many private sector lenders are planning to ramp up their own direct marketing.

Indeed, there are factors that may tip the scales in the favor of loan direct marketers. Approximately 100 private lenders reportedly exited the federal student loan program earlier this year after Congress reduced the government’s financial support it gives to private lenders. This was one of the factors contributing to Student Loan Xpress closing its doors in April.

This issue of liquidity has since been addressed by Congress, but the ongoing turmoil in the student loan marketplace has left the door open for some new players.

“Direct marketing is significantly on the rise in part because there is a lot of anxiety in the market right now,” said John Dean, special counsel to the Consumer Bankers Association. “The press is suggesting that borrowers need to be more aggressive in seeking out loans and the turmoil in the financial markets has discouraged some from making loans” which is leading many to see opportunities online, he said.

My Rich Uncle, a direct-to-consumer student loan provider, has experienced 200% annual growth for the past several years, according to Raza Khan, president and co-founder of the company.

“There’s not a lot of attention paid to needs of students and parents [regarding student loans],” Khan said. This was why his company, which provides information about how to be a smarter borrower and minimize debt, was created, he added.

The loan transactions take place primarily online, while My Rich Uncle markets through a variety of channels.

“Direct marketing is going to be the primary method by which students get loan products in the future,” Khan said. He said this is because the DTC model puts consumers in control and enables them to shop around: “The typical sales model, [which takes place] through universities, can’t provide that level of attention.”

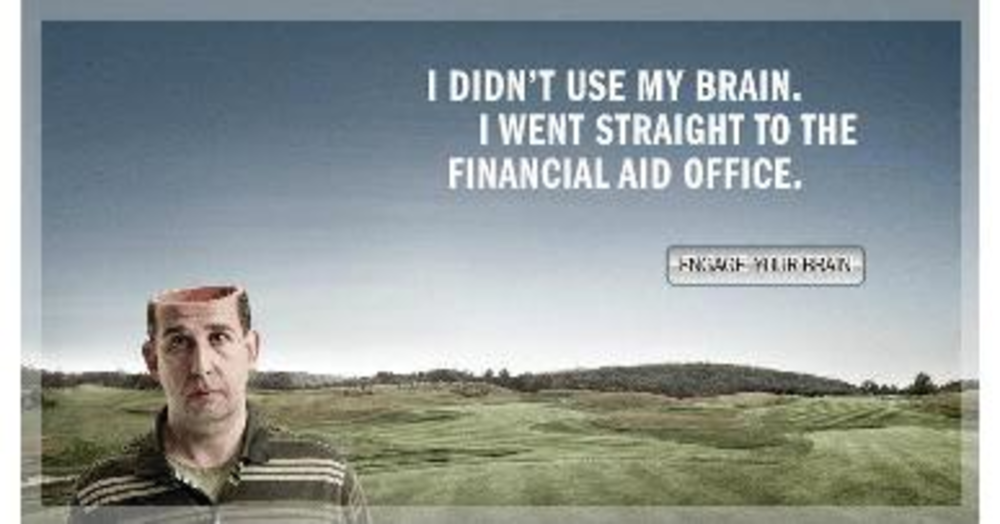

Rising tuition costs and, until recently, stagnant federal loan limits, are among the reasons more students turn to private loans to finance their higher education. There’s also the argument that school financial aid administrators limit students’ loan options to the few companies that the financial aid office has approved.

In addition to the improved support for students using federal loans, the July 1 changes regulate the relationship between financial aid offices and lenders, and prohibit certain financial arrangements.

Last year, New York State attorney general Andrew Cuomo launched an investigation into the relationship between universities and lenders that uncoveredrevenue sharing and other financial arrangements between the institutions.

Some direct marketers also engage in questionable practices. Cuomo extended his investigation to direct marketers and found that many engage in fraudulent and illegal business practices. As a result, his office developed a code of conduct that was designed to make it easier for students to compare the terms of loans offered through direct marketing that has been agreed to by many of the major players.

In a settlement that arose from the investigation, Student Financial Services Inc. agreed in December to pay some of the nation’s top universities, school athletic departments and sports marketing firms that agreed to let the company directly market loans using their logos and mascots without evaluating loan quality.