Many bricks-and-mortar and e-commerce retailers showed disappointing figures over the holidays, despite predictions that sales would either stay flat or rise slightly. But experts are still hopeful for 2009, saying that retailers’ marketing spend — namely online — will continue to increase.

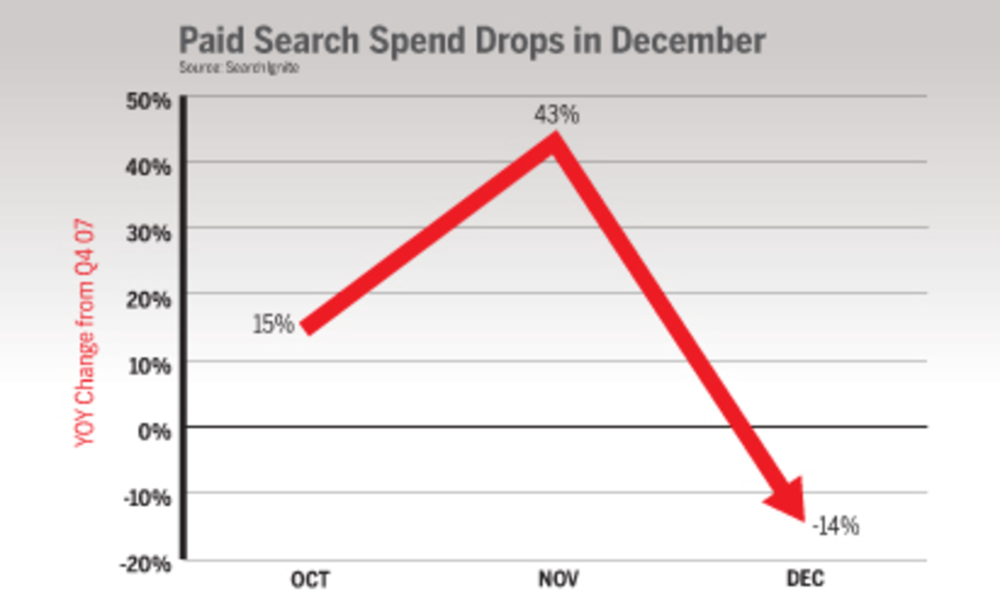

Search engine marketing has long been a major driver of e-commerce sales. One report, by SearchIgnite, said retailers reduced their overall search spend by 14% in December compared to the previous year. However, some analysts say search spend will be a primary focus in the coming year.

“Retail sector search spending will grow in 2009, regardless of what becomes of some individual retailers,” said Michael McVeigh, associate director of strategic analysis for Zeta Interactive. “The majority of [retail] advertisers still have clear untapped ROI in search marketing. The economic downturn is focusing retailers’ attention and budget on efficient, measurable marketing programs, and search marketing continues to deliver.”

“Retailers front-loaded their spend this quarter, which is completely different from historical holiday seasons where retailers would really ante up in the latter half to drive traffic,” said Roger Barnette, president of SearchIgnite. Some retailers also may have seen a declining ROI from search since most of the Internet buyers had already made purchases earlier in the quarter, he continued.

Though more people shopped online this year than previous years, they spent less per transaction, said Adam Lipsman, senior analyst at ComScore. As a result, ComScore reported that overall online sales were down 3% for the holiday season, with some categories, such as music, movies, office supplies and computer software, faring particularly badly.

John McAteer, industry director for Google Retail, said he also noticed retailers offering up deals earlier than ever.

“This year we started seeing influxes of deals and promotions as early as the first week in October, a full month and a half earlier than usual,” he said. “By the beginning of November, we were already seeing Black Friday pricing.”

While the economy was the overwhelming factor contributing to the sales declines, Lipsman points out that this year’s holiday shopping season had five fewer shopping days than last year.

“Sales per day only went up a couple of percentage points, and it wasn’t enough to compensate for having 15% fewer days,” he said.

However, there was some good news online. Macy’s reported online sales for Macys.com and Bloomingdales.com combined were up by 39.1% in December. And, promotional e-mails appeared to be a favored marketing strategy for many online retailers late in the holiday season.

“People were clicking over to retail sites and purchasing after coming from their e-mail applications, indicating retailers were able to get some traction from their promotional e-mails,” Lipsman said.

Holiday retail e-mail volume was up 15% this year compared to last year, said Chad White, author of The Retail Email Blog and research director at Smith-Harmon. “Promotional retail e-mail volume hit record levels,” he noted, adding that the emphasis was on heavy discounting and free shipping.

In addition, there were more e-mail campaigns aimed toward getting recipients to sign up for a series of promotional offers or those that required an additional opt-in from consumers. Petco, QVC, RadioShack and Sam’s Club all ran campaigns requiring an additional opt-in to receive daily e-mail offers.

“Online retailers had to play the same sorts of games that bricks-and-mortar retailers do and draw traffic the same way this year” by using promotional discounts, said Erin Armendinger, managing director, Baker Retailing Initiative.

Coming off one of the worst holiday seasons in decades, the big question is, “What now?” Because multichannel marketers aren’t seeing the ROI from other marketing channels right now, either, “they’re still trying to decide where to devote more their budgets,” Barnette said.

“People got numbed to big discounts over the holidays because everything was on sale,” said Jay Suhr, SVP, creative services and account planning at agency T3.

In 2009, Suhr expects marketers to adjust their messaging to focus more on the broader value proposition than a discount. Hyundai is already doing this with its new Hyundai Assurance plan, which enables new car buyers to sell their car back to Hyundai if they lose their job.

“This is getting the consumer to say, ‘I might think about a Hyundai,’ which is exactly what marketing is supposed to do,” said Suhr.

Online marketing could be a big winner in this environment. “We may see large advertisers increasingly shift their budgets to online in 2009 because it is a relatively cheaper channel than TV,” Lipsman said.

In the face of continued bad economic news, however, many SearchIgnite customers aren’t committing to yearly budgets anymore and are instead taking a quarter-to-quarter or month-to-month approach.

“We don’t expect the bottom to fall out of search,” Barnette said, “More multichannel retailers are signaling that they’re planning to shift more of their overall marketing budgets to search in 2009.”

“Current economic conditions are challenging our clients to look at budget plans from both short-term and long-term perspectives,” said Noah Elkin, managing partner at Steak. “Clients, particularly those in retail, have had to reduce their budgets in the near term… At the same time, they can’t afford to lose sight of the longer term goals of growing traffic and conversions.”