The fluctuations of the online ad-buying economy consistently frustrate e-commerce businesses. Google, for instance, recently changed how retailers can purchase and oversee ad bids on its Google Shopping service. Consequently, search agency Adlucent, which specializes in the retail vertical, released on September 6 a product designed to help retailers better manage their ad bidding for Google Shopping.

The shift driving the need for Adlucent’s new Precision Product Targeting for Product Listing Ads occurred in May, says company CTO and founder Michael Griffin. At the time, Google offered Product Search, a free service through which retailers submitted their catalogs so their wares were searchable on Google.

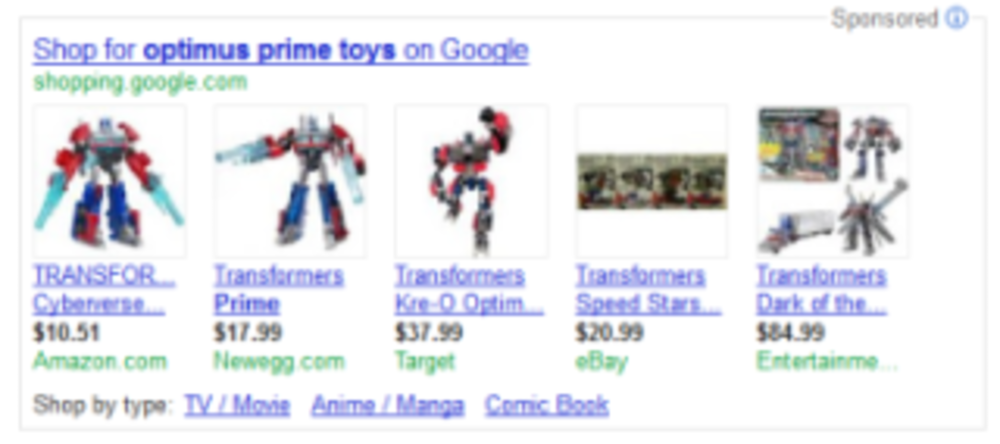

In May, however, the search giant changed that free service into a paid service called Google Shopping and combined it with Product Listing Ads (PLAs), which allow online merchants to place a thumbnail image alongside an ad. Google also surfaced PLAs to a more prominent position at the top of the search engine results page.

“That was a dramatic shift for retailers, who were scrambling to figure out what to do, how to take advantage of this change, and really prepare for the holidays, which were around the corner,” Griffin says, who characterizes these changes as “one of the biggest Google has made in terms of retail paid search.” He also notes that the presence of images next to listings has dramatically increased click-throughs.

Camera and electronics retailer Adorama, which was involved in Adlucent’s Precision Product Targeting pilot program since mid-2011, saw a 176% year-over-year increase in click-through rate, and an average conversion rate increase of 100%, according to a release.

The current issue with Google Shopping, Griffin says, is that Google doesn’t offer granular controls for retailers to manage their ad bidding practices. “[Google] gives, out-of-the-box, very broad control over performance,” he says. Specifically, retailers can only oversee advertising over a category of products—shoes in general, for instance. “But we know that retailers want control over advertising of individual products,” Griffin says.

Retail search marketing, Griffin notes, is “dramatically different” than search marketing for other verticals. “It’s the dynamic nature of retail,” he says, as retailers compete on prices and have to make tactical adjustments due to seasonality and inventory changes. “Because of the dynamic nature, algorithms and methodology need to be different.”

And because profit margins occur for retailers on a product-by-product basis, Griffin says, retailers need deeper control than Google Shopping currently provides, adding that Adlucent’s Precision Product Targeting for Product Listing Ads is designed to fill this need.

“A retailer might have great margins for one designer, but not great margins for another designer,” Griffin explains. “So it’s very important to know which one to promote.”

Profit margins for Adorama fluctuate rapidly, says Brian Green, the camera and electronic retailer’s VP of marketing. For instance, the 2011 Japan Tsunami drastically affected camera inventory. Other factors that create need for Adorama to monitor its wares on a product-by-product basis include pricing set by the manufacturer and consumer demand.

“A new camera is announced and maybe the manufacturer will limit how many units get sent to whom to control the buzz,” Green says, adding that without product-level control over ad bids, “it’s easy to start bleeding money and have [ad buys] operate as a black box, which is typically what happens at the category level.”

Ultimately, Adlucent is betting big that Google Shopping PLAs will be a significant force in paid search ad buys. In roughly a year, Griffin predicts these PLAs will drive upwards of 30% to 50% of paid search buys among retailers. “This will be a very, very big deal,” he says. “Google’s promoting it heavily and we’re promoting it heavily.”

Griffin anticipates that next year bids for PLAs will be higher than bids for text ads, and cost-per-clicks (CPCs) for PLAs will be 10% to 20% higher than text ads. Currently, he concedes, CPCs are 20% lower than they are for text ads.

However, Griffin says that as PLAs become more popular, more retailers will bid, which will drive up CPCs. In turn, Google will more-prominently feature PLAs, in theory continuing the growth cycle.