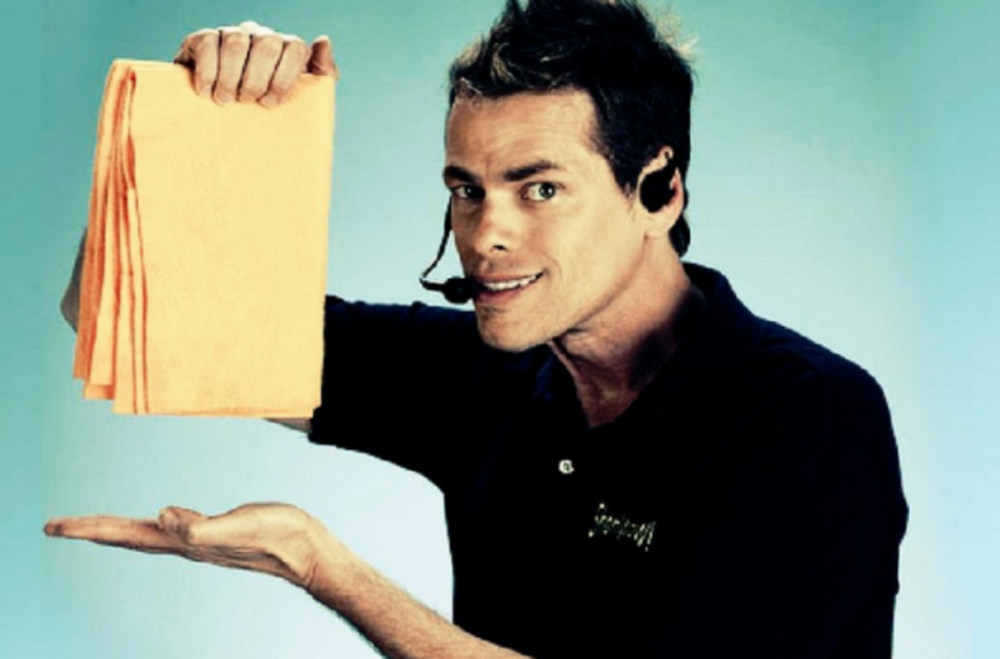

During the brief lull between the digital media “newfronts” and the television media “upfronts,” Jason Wiese of the Cabletelevision Ad Bureau (CAB) released a powerpoint paean to a dozen direct response TV stars that will never see an awards runway. But marketers of the Snuggie, the ShamWow, and OxiClean come out looking more like successful TV producers than product hawkers in Wiese’s analysis of 10 years of media activity drawing mostly on Nielsen data. In a supposed multichannel world, these household names were born, thrived magnificently, and will fade away solely on cable and broadcast television.

The CAB’s VP of strategic insights dug out these a-MA-zing figures (as Billy Mays might say), which account for :30 and :60 spots only, and not the full-length infomercials for which the products are so famous:

- Ninety-seven percent of the $287 million in media spent since 2004 by 12 top direct response brands was put in to TV. Print accounted for most of the remaining 3%, with just over $100,000 spent online. (Other brands studied were Jack LaLanne’s Power Juicer, Magic Mesh, Mighty Putty, PajamaJeans, Pedi Egg, Perfect Brownie, Shake Weight, Slap Chop, and Twin Draft Guard.)

- TV products’ broadcast blitzkrieg is all-encompassing. The brands each ran on 40 different TV networks during the average year and 60 channels in their year of highest activity. The Shake Weight (which probably got as much exposure via parodies as it did in paid media) ran on 74 different networks during 2011.

- The ubiquity of DRTV brands extends to time as well as place. While more than half of their TV buys were devoted to daytime and prime time, 13% of their dollars went to early fringe, 12% to overnight, and 7% to late fringe.

- DRTV brands use television to drive customers online. Comparing results over two concurrent six-month periods last year, CAB found that a group of brands that collectively increased their TV spends by 57% showed a 44% increase in unique visitors to their sites. Another group that decreased TV spend by 23% saw a 25% drop in uniques. One of those was ADT, which bought 10 fewer networks and experienced a 38% drop-off in uniques.

“Nielsen reports that Americans still watch 110 hours of TV every month. That dwarfs the amount of time that is spent on all the Internet portals,” says Wiese, who wants to arm the CAB’s cable network members with numbers painting TV in a favorable light. News reports about the cable industry in recent months have focused on the introduction of cheaper “skinny bundle” packages in response to customer sticker shock. And last week the Interactive Advertising Bureau released a study saying that the newfronts would help lift digital ad spending to $10 billion next year, mostly at cable TV’s expense.

Wiese chose DRTV brands to tell the CAB’s story because of the special way they seem to resonate with Americans. “These products became part of pop culture. You see hundreds of comedians parodying them on TV and thousands of normal people parodying them on the Internet,” says Wiese. “The interesting thing is that the most popular DR brands are spending more money in TV now than they did a few years ago.”

Seventy percent of the 50 most active DRTV brands spent more than half their budgets on TV in 2014, according to Nielsen, compared to 68% that did so from 2004 to 2014.